Shares of Royal Caribbean Group (NYSE: RCL) sailed up in pre-market trading on Tuesday after the cruise company reported Q4 adjusted loss of $1.12 per share, narrower than analysts’ consensus estimate of a loss of $1.34

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Total revenues in the fourth quarter soared by 164.7% year-over-year to $2.6 billion but still missed analysts’ expectations by $10 million. In 2022, RCL’s business returned to full operations while delivering “positive Adjusted EBITDA and Operating Cash Flow by consistently growing revenue and controlling costs.”

Looking forward, management now expects Q1 adjusted loss is expected to be in the range of $0.65 to $0.85 per share versus the consensus of a loss of $0.85. For FY23, RCL is experiencing a “record-breaking WAVE season” as demand remains strong with “seven biggest booking weeks in the company’s history have occurred since the last earnings call in November 2022.”

For cruise companies, the WAVE season is historically from January to March as many cruises are booked during these months at a discount.

The company has projected adjusted FY23 EPS to range between $3.00 and $3.60 versus estimates of $3.23.

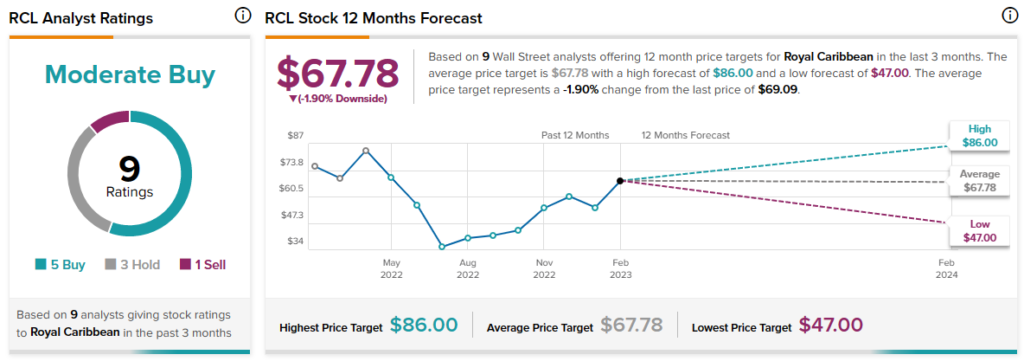

Overall, Wall Street analysts are cautiously optimistic about RCL stock with a Moderate Buy consensus rating based on five Buys, three Holds, and one Sell.