ChargePoint (NYSE:CHPT) is facing significant challenges. The electric vehicle (EV) charging station network operator has witnessed a substantial decline in revenue, and profitability remains elusive. Meanwhile, ChargePoint’s stock has plummeted by nearly 85% over the past year, leading to mounting concerns among investors regarding the company’s ability to navigate this tough market environment.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In its attempts to get the company back on track, ChargePoint has decided to undertake a “strategic reorganization” of the business. Last week, it announced a 12% cut to the workforce that should lead to annual opex savings of $33 million.

However, RBC analyst Chris Dendrinos is not convinced by these measures. He stated, “The $33mm reduction in opex from the 12% workforce reduction was below our expectations and is below what we think is needed to achieve positive EBITDA in CY4Q24.”

As a result, Dendrinos has lowered his EBITDA estimates and now sees adj. EBITDA hitting $(129.9) million vs. $(66.8) million beforehand in F2025.

Management has indicated that there are no immediate plans for further workforce reductions. However, they emphasized that such decisions will depend on the company’s ability to meet its financial and operational targets.

U.S. publicly reported charging port installations posted growth of ~23% year-over-year in 2023 (vs. BEV sales growth of 48%), and in order to maintain the current charging port/EV ratio, Dendrinos reckons charging port installations will need to increase by 35% in 2024. However, since 2Q22, the quarterly rate of charging port installations has stayed relatively flat, without showing any “signs of accelerating in the near-term.”

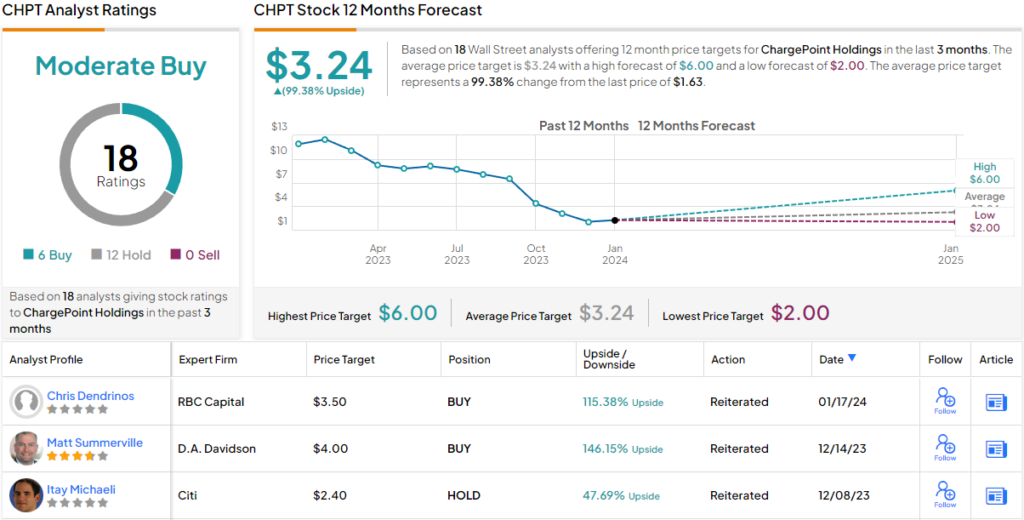

Nevertheless, despite all these developments, Dendrinos still remains on ChargePoint’s side. “At this time we are maintaining our Outperform, Speculative Risk rating as we await additional detail from the company on the strategic plan and financial/operational targets expected with earnings in early March,” he explained. “More specifically, we are looking for additional detail on the revenue and gross margin progression anticipated to achieve the year-end target.”

However, that Outperform (i.e., Buy) rating is accompanied by a new reduced target. Dendrinos now has that figure at $3.5 compared to $4 previously. That said, the revised target still makes room for one-year returns of a very handsome 115%. (To watch Dendrinos’s track record, click here)

Elsewhere on the Street, the stock claims an additional 5 Buys and 12 Holds, all coalescing to a Moderate Buy consensus rating. Going by the $3.24 average target, investors will be pocketing returns of 99% a year from now. (See ChargePoint stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.