Royal Bank of Canada (RY), the 10th-largest bank in the world, is scheduled to report its third-quarter financial results on August 25 before markets open.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Over the past year, the bank stock has jumped more than 30% and is currently trading close to C$130. (See Royal Bank of Canada stock charts on TipRanks)

Strong earnings could drive RBC shares higher, so let’s have a look at what analysts are expecting for the second quarter.

Analysts on average expect RBC to report adjusted EPS of C$2.69 in Q3 2021, indicating a growth of 20.6% from the prior-year quarter (C$2.23 per share). Revenue is expected to come in at C$12.21 billion, representing an increase of 5.9% from C$11.53 billion reported in the third quarter of 2020. RBC topped EPS estimates in the past fourth quarters.

The Delta variant of COVID-19 could have reduced RBC’s third-quarter earnings performance, as the bank might have become more cautious about releasing funds from loan loss reserves recognized earlier.

On August 18, Scotiabank analyst Meny Grauman maintained a Buy rating on the stock and a C$148 price target. This implies 12.2% upside potential.

Grauman wrote in a report, “After peaking in Q1, beats were smaller in Q2 and we expect even smaller beats in Q3.”

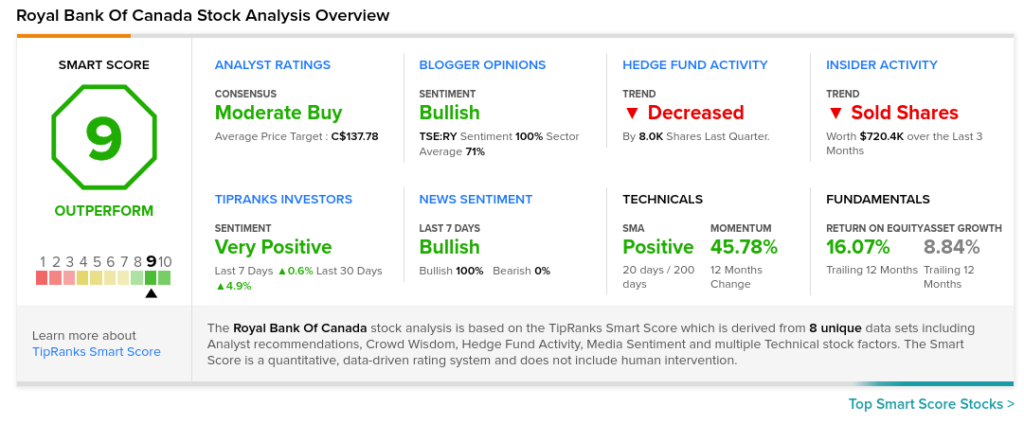

The rest of the Street is cautiously optimistic on RBC, with a Moderate Buy consensus rating based on five Buys and two Holds. The average Royal Bank of Canada price target of C$137.78 implies 4.4% upside potential to current levels.

TipRanks’ Smart Score

RBC scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the overall market.

Related News:

Registration Opens for RBC Race for the Kids

RBC Launches New Brand Platform for Tokyo 2020 Olympic Games

Scotiabank Q3 Profit Beats Expectations