Gambling giant the Rank Group (GB:RNK) reported a 2% increase in its net gaming revenue (NGR) in the first quarter of the financial year 2022-23 – but warned of higher energy costs and a slowdown in customer spending.

The company says it expects to “to remain under significant pressure this year”.

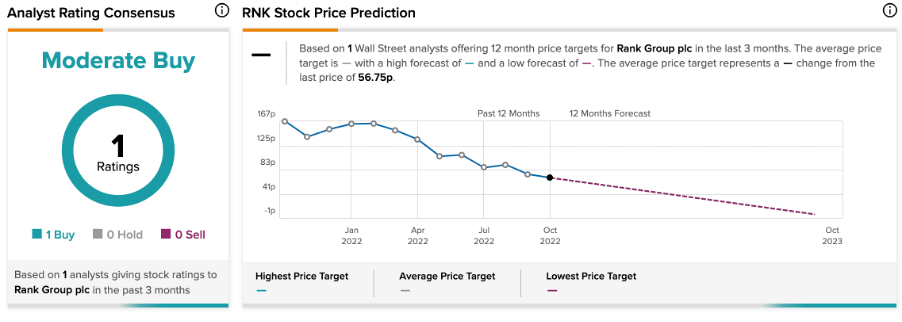

Shares were trading down by almost 10% after the news, having fallen by 65% this year.

Prices have struggled since the outbreak of COVID, which led to the shutdown of its casinos.

Rank Group is a gaming and leisure company and is known for its brands such as Mecca Bingo and Grosvenor Casino venues in the UK.

Talking about the first quarter’s performance, the revenues were mainly supported by strong growth in digital brands. The digital revenue grew by 13% to £48.9 million.

This was offset by the poor performance of its land-based segment, which was hit by higher wages, food costs, and supply-side disruptions. This was despite the increase in the number of visitors which ended up spending less in its casinos.

The company expects its energy costs in this financial year to be around £34 million, up from £23 million in the last year.

Among its regions, London performed fairly better than other locations. Grosvenor venues in London saw an increase of 21% in revenues. However, this was negated by a 17% decline in revenues outside London.

Is Rank Group a buy?

According to TipRanks’ analyst rating consensus, Rank Group stock has a Moderate Buy rating, based on one Buy recommendation.

Conclusion

Inflation is not going anywhere soon, and the company’s chain businesses will remain under pressure from reduced consumer spending.

The company is betting big on its digital business and will continue its investments in the technology platform to drive more growth in this segment.