Shares of Rambus (NASDAQ: RMBS) were up in the morning trading at the time of writing on Thursday after the company that designs, develops, and licenses chip interface technologies and architectures was upgraded by top Jeffries analyst Mark Lipacis to a Buy from a Hold and raised the price target to $65 from $45. The analyst’s price target implies an upside potential of 12.2% at current levels.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Lipacis commented, “We estimate 2026 EPS power of $3.30+ underpinned by nearly 30% [compound annual growth rate in product revenues] over the next 4 years and steady high FCF-earning IP segments.”

The analyst added that Rambus is in a “strong position” to increase its share in the registering clock drivers chips market while also expecting its total addressable market (TAM) to double by 2024 from 2021.” Lipacis anticipates that the company’s market share will go up to 50% in registering clock drivers, up from around 25% in 2022.

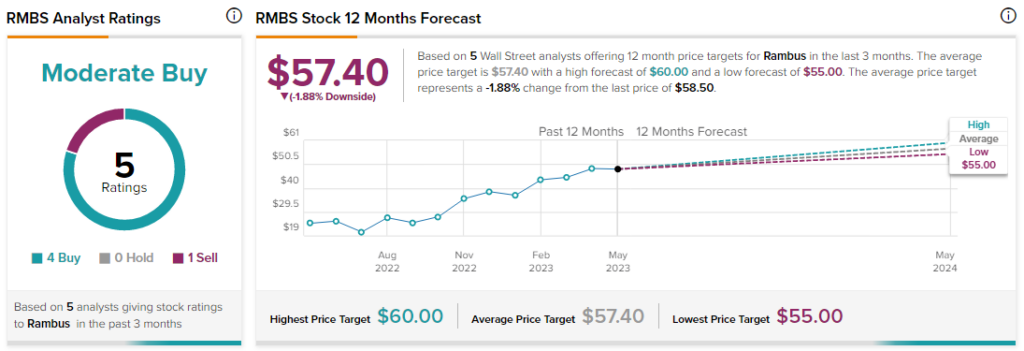

Overall, analysts are cautiously optimistic about RMBS stock with a Moderate Buy consensus rating based on four Buys and one Sell.