After D-Wave Quantum (QBTS) passed its Q1 earnings report with flying colors last week, which reignited investor excitement around the real-world promise of quantum computing, attention now shifts to the rest of the small-cap quantum space. Rigetti Computing (RGTI) steps into the spotlight later today, but Quantum Computing Inc. (QUBT) could steal the show when it reports on Thursday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still a Risky Bet

Of the publicly traded quantum companies, QUBT is arguably the most speculative. Despite boasting a $1.18 billion market cap and a staggering 1030% stock price rally over the past year, the company currently carries minimal analyst coverage, with the latest rating issued last November, reflecting its high-risk, high-reward profile in a sector still defining its commercial viability.

That said, QUBT has laid some promising groundwork. The company is preparing to launch production at its new quantum photonic chip foundry in Tempe, Arizona, with customer preorders already in place. Leadership changes in early May, naming Dr. Milan Begliarbekov as Chief Operating Officer and Dr. Pouya Dianat as Chief Revenue Officer, are designed to support its shift from R&D mode to commercialization, particularly in high-demand telecom and datacom markets.

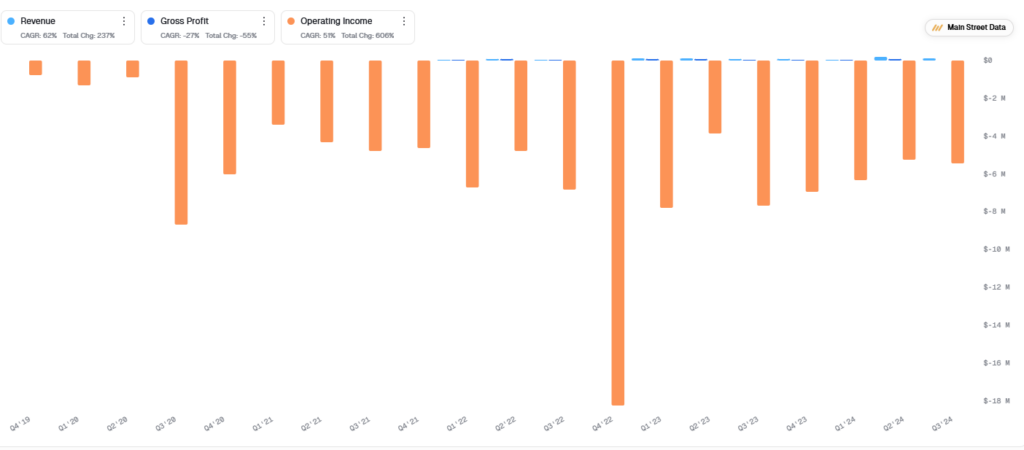

Financially, the story remains challenging. QUBT reported just $62,000 in revenue last quarter alongside a $51.2 million net loss. However, expectations are gradually rising: for Q1, analysts forecast revenue of $100,000 and an EPS of -$0.07. That may still seem modest, but QUBT has outperformed its quantum peers on EPS beats over the past year, delivering better-than-expected earnings 33% of the time, compared to the industry average of 50%. While sales beats have lagged, QUBT’s performance is, surprisingly, in line with the broader sector.

For Thursday’s call, the spotlight will be on execution: updates on chip production, order fulfillment, and, most critically, a roadmap to sustainable revenue growth. QUBT has been priced for potential. Now it’s time to deliver on it.

Is QUBT Stock a Buy?

As stated above, Quantum Computing Inc.’s latest rating was issued six months ago. However, the average price target for QUBT stands at $8.50, suggesting a 1.05% downside.