QuantumScape (NYSE:QS) shares declined 15% yesterday to close at $6.74 after one of the top Morgan Stanley analyst Adam Jonas downgraded the rating on the electric vehicle (EV) battery maker to Sell from Hold. Further, Jonas slashed the price target by a solid 67% to $4 from $12 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Jonas commented, “While solid-state batteries may still represent the future of energy storage, the path to getting there is proving to be more difficult and longer-dated than we and the market had expected.”

Further, the analyst cited a tough funding environment, and the unpredictability around the time required to scale and gain acceptance from manufacturers as other headwinds.

Notably, on October 26, QuantumScape reported a Q3 loss of $0.27 per share, which more than doubled from $0.13 in the prior-year quarter. The pre-revenue company expects to incur considerable expenses and losses in the near term.

What is the Forecast for QS Stock?

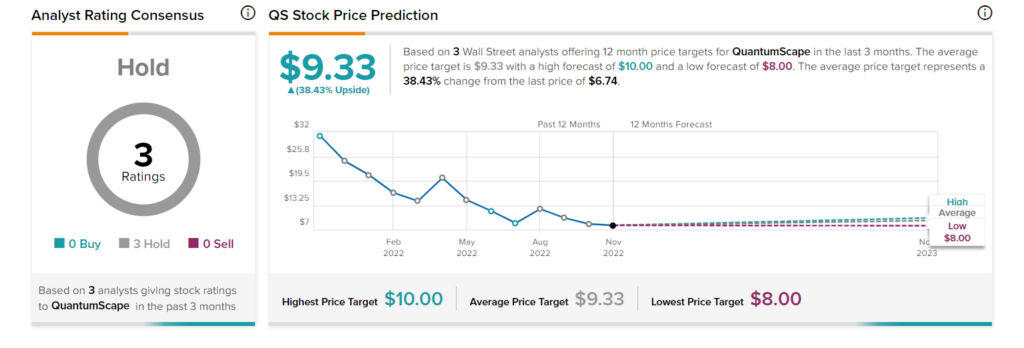

QuantumScape stock has a Hold consensus rating based on three Holds assigned in the past three months. The average QS stock price target of $9.33 implies 38.4% upside potential.