Public investors now have more ways to invest in quantum technology as the sector moves from lab tests to early market use. A new report by Quantum Insider shows that the market is still small, but it is becoming more structured. The report groups listed companies into four types: quantum computer makers, post-quantum security firms, software developers, and large global tech companies that include quantum research in their wider R&D programs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Pure Plays and Security Firms

In the first group of pure-play quantum firms, IonQ (IONQ), D-Wave Quantum (QBTS), Rigetti Computing (RGTI), and Quantum Computing Inc. (QUBT) lead the list. IonQ reported $20.7 million in Q2 revenue and expects $82–100 million for the full year, supported by $1.6 billion in cash after a new equity raise. D-Wave Quantum sells quantum annealing systems and holds $304 million in cash. Rigetti Computing continues to develop its superconducting systems with $571 million in reserves. Quantum Computing Inc. focuses on photonic processors and has $349 million in cash. However, all four remain pre-profit and rely on long cash runways to support heavy R&D spending.

In contrast, post-quantum security firms such as SEALSQ Corp (LAES)and BTQ Technologies (BTQ) already sell products that can be used today. These companies protect data against future quantum attacks. SEALSQ, based in Switzerland, expects $17.5–20 million in 2025 revenue and has about $220 million in cash, while BTQ Technologies builds post-quantum encryption tools for blockchain systems.

Software and Big Tech

Software developers such as Arqit Quantum (ARQQ) and Zapata Quantum (ZPTA) are working to make quantum systems easier for companies to use. Arqit generates encryption keys from its cloud platform, while Zapata develops tools that link enterprise data to quantum and classical systems. Both face the challenge of proving that quantum methods can outperform traditional computing.

Meanwhile, large global firms treat quantum research as a long-term bet rather than a core business. IBM (IBM), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL) (GOOG), Intel (INTC), Nvidia (NVDA), and Honeywell (HON) all run quantum programs. Their projects focus on scaling qubits, improving simulation, and preparing for future commercial use. These companies allow investors indirect exposure to quantum progress without the same financial risk as smaller firms.

Investors and Outlook

The report notes that most public quantum firms are still early-stage. Annual revenues across leading hardware names total only about $40 million, far below their multi-billion dollar valuations. Still, strong cash reserves, government support, and early enterprise trials help sustain investor interest.

For investors, the key factors to watch are cash runway, R&D progress, and the quality of customer contracts. While the market is uneven and profits remain distant, the growing number of listed quantum firms gives investors more ways to take part in a field that is slowly moving from research to commercial use.

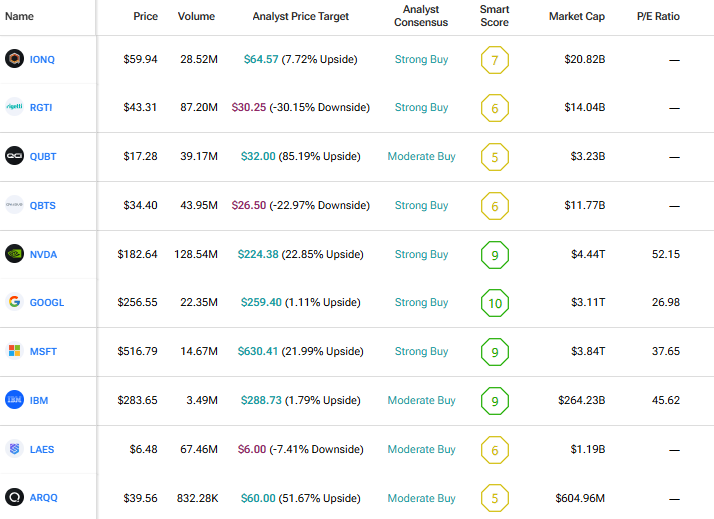

Using Tipranks’ Comparison tool, we’ve assembled and compared all the publicly traded quantum computing companies appearing in the article. It’s a great way for investors to gain a broader perspective on each ticker and the quantum computing industry as a whole.