Today was not a good day for chip stock Qualcomm (NASDAQ:QCOM), no matter how you cut it. In the closing minutes of Thursday’s trading session, Qualcomm was down over 7%, thanks mostly to a growing slate of troubles in China around the iPhone and around chips in general.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of several troubles socking Qualcomm today was the ongoing issue of Apple (NASDAQ:AAPL) and its iPhone’s status in China. With Chinese officialdom suddenly deeply, deeply concerned about the security ramifications of having iPhones near sensitive government business, that’s taking the iPhone off the table at the government level in China. From there, it’s not hard to imagine larger bans elsewhere, and that means trouble for Qualcomm as well, which supplies Apple with its broadband modems.

However, troubles didn’t stop there. Huawei also took a shot at Qualcomm, bringing out a 7nm 5G chip known as the Kirin 9000. The Kirin 9000 chip was born out of desperation as Huawei found many of its conventional supply routes cut off. It then developed the Kirin chip, which was at least somewhat on par with the Qualcomm lineup. That in and of itself proved a surprise because, as far as everyone knew, Huawei—and SMIC, the largest foundry in China that actually makes the chips—didn’t have the necessary tools to make such chips. Additionally, reports noted that neither Huawei nor SMIC should have been able to buy the technology that could make those chips.

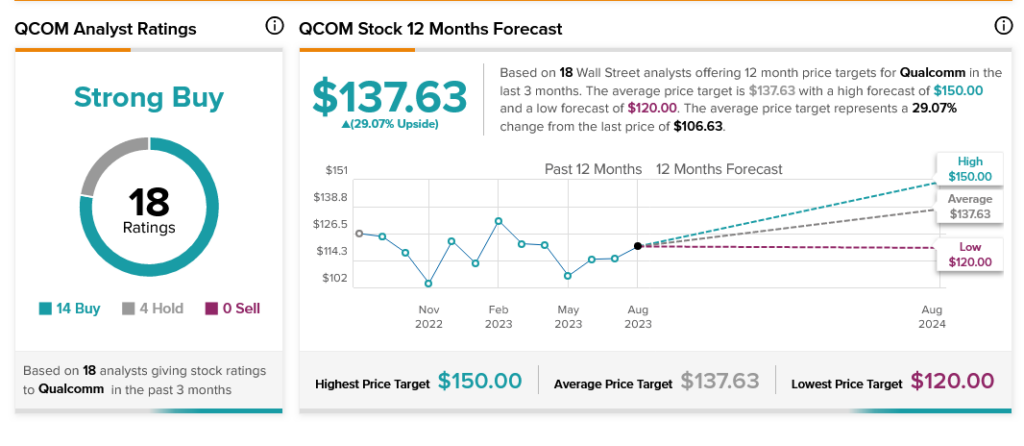

However, analysts are largely unfazed by these developments. A combination of 14 Buy ratings and four Holds makes Qualcomm stock a Strong Buy by analyst consensus. Further, with an average price target of $137.63, Qualcomm stock offers investors 29.07% upside potential.