Technology company Qualcomm Inc. (NASDAQ:QCOM) is scheduled to report its results for the second quarter of Fiscal 2024 on May 1, after the close of the market. Qualcomm designs and manufactures semiconductors, software, and services related to wireless technology. The company’s Q2 results are expected to reflect the gradual recovery in the smartphone market. Qualcomm is set to benefit from the accelerated adoption of 5G and the generative artificial intelligence (AI) boom.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Moreover, QCOM’s high-end processors and RF technology (radio frequency) are being deployed in more and more handsets, PCs, laptops, automotive, and IoT applications (Internet of Things), which could boost its top line.

QCOM’s Q2 Results: Street’s Expectations

The Street expects Qualcomm to post an adjusted profit of $2.32 per share in Q2 FY24, 7.9% higher than the prior-year period. The consensus for revenue is pegged at $9.34 billion, largely similar to the comparative prior year period. Qualcomm has exceeded the Street’s estimates in all past eight quarters.

The consensus forecast is in line with the company’s own guidance. For Q2 FY24, Qualcomm guided for adjusted earnings between $2.20 and $2.40 per share. Meanwhile, the company forecast revenue in the range of $8.9 billion to $9.7 billion.

To achieve its targets, QCOM is building on the ongoing momentum in its Snapdragon platform and advanced technology in various applications. Qualcomm also announced its entry into the AI PC market with its new Arm architecture-backed processor called Snapdragon X Plus chip. The chip is expected to be launched by mid-2024.

What is the Future Prediction for Qualcomm?

Analysts remain split about Qualcomm’s stock trajectory. In April alone, ahead of the Q2 print, QCOM received five Buy ratings, two Hold ratings, and one Sell rating.

The bullish views point to the massive potential of AI in edge deployment, where Qualcomm is expected to take center stage. Bernstein analyst Stacy Rasgon lifted the price target on QCOM to $200 (18.2% upside) from $170 and maintained a Buy view on the same premise.

Similarly, Susquehanna analyst Christopher Rolland increased the price target to $205 (21.2% upside) from $175 while reiterating his Buy stance. Rolland’s optimism stems from Qualcomm’s transition to AI despite having lost share to peers in the handset market. Plus, Rolland is encouraged by a higher share of handset launches with 5G capabilities during the quarter and beyond.

Meanwhile, Cantor Fitzgerald analyst C J Muse maintained a Hold on QCOM but lifted the price target to $190 (12.3% upside) from $150. Muse cited higher application of Qualcomm’s chips in Huawei and Xiaomi handsets as well as cyclical recovery in the other verticals for the updated price target.

Is Qualcomm a Buy, Hold, or Sell?

On TipRanks, QCOM stock has a Moderate Buy consensus rating based on 15 Buys, 10 Holds, and one Sell rating received during the past three months. The average Qualcomm price target of $171.27 implies 1.2% upside potential from current levels. In the past year, QCOM shares have gained 46.1%.

The company also pays a healthy dividend of $0.85 per share, reflecting an above-average yield of 2.03%.

Insights from Options Trading Activity

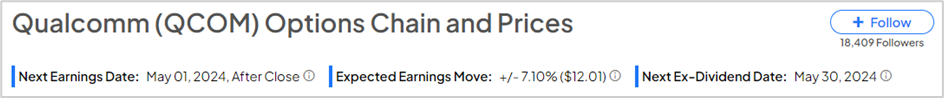

It’s worth noting that options traders are pricing in a +/- 7.10% move on earnings, higher than the previous quarter’s earnings-related move of -4.98%.

The expected move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Thoughts

Qualcomm is at the crux of a crucial shift in AI into edge computing, which is expected to benefit the demand for its technology. Analysts are optimistic about accelerated applications in 5G and RF market shares and long-term applications in the automotive and IoT segments for Qualcomm.