Qatar National Bank (QNB) has moved to JPMorgan’s (JPM) Kinexys blockchain to handle corporate payments in U.S. dollars, a step executives say could transform how treasurers manage cash flows.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Faster Payments Replace Old Banking Rails

QNB, one of the Middle East’s largest banks, confirmed it is now using Kinexys to process transactions, according to Bloomberg. The change marks a break from traditional banking rails where cross-border transfers can take days and are restricted to weekdays.

“It’s a treasurer’s dream,” said Kamel Moris, QNB’s executive vice president of transactional banking. He pointed to the 24/7 window that blockchain enables, adding that payments can now be guaranteed “as fast as two minutes.”

Kinexys Processes Billions Each Day

Kinexys currently handles about $3 billion in daily transactions, a fraction of the $10 trillion JPMorgan processes overall. The platform uses a permissioned blockchain, meaning only approved participants can move funds held on deposit with the bank. This extra layer of control aims to keep the system secure while speeding up transfers.

In June, Kinexys tested crosschain settlement by linking its permissioned network with Ondo Finance’s public testnet through Chainlink (LINK-USD). The pilot showed how blockchain can bridge real-world assets and traditional payments.

Stablecoins Still on JPMorgan’s Radar

Although Kinexys is designed for dollar payments inside JPMorgan’s own ecosystem, stablecoins remain part of the conversation. JPMorgan CEO Jamie Dimon said last week that he is “not particularly worried” about stablecoins, though he noted that banks must keep an eye on the space.

Regulatory clarity and adoption are pushing stablecoin usage higher. Data from RWA.xyz showed net inflows surged more than 320% in the third quarter, with USDT and USDC leading.

Is JPM a Good Stock to Buy?

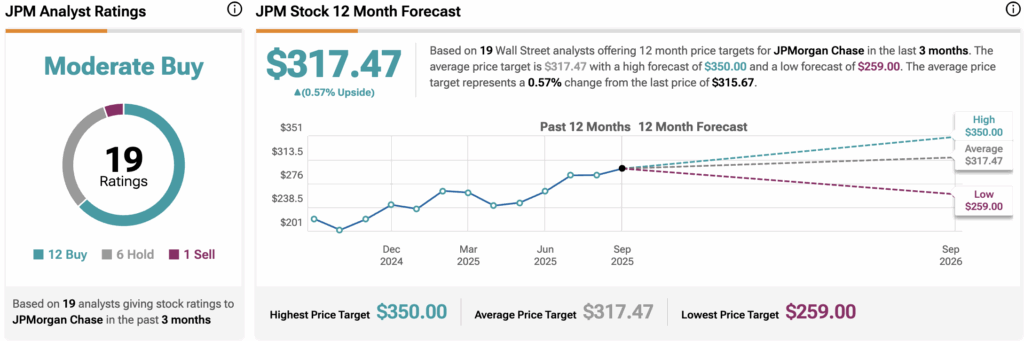

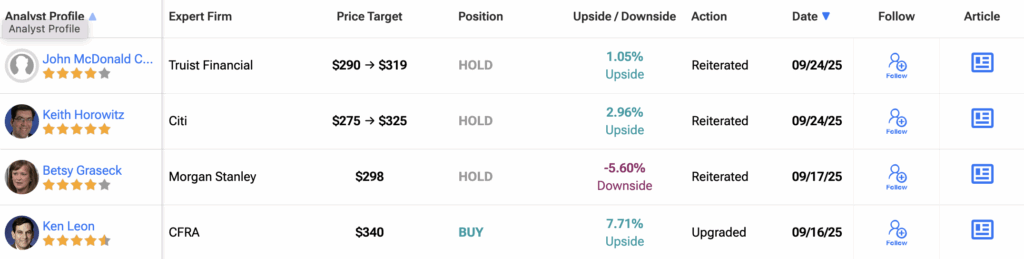

Wall Street remains cautiously optimistic on JPMorgan Chase. Based on 19 analyst ratings over the past three months, the stock carries a Moderate Buy consensus. The average 12-month JPM price target sits at $317.47, implying a modest 0.57% upside.