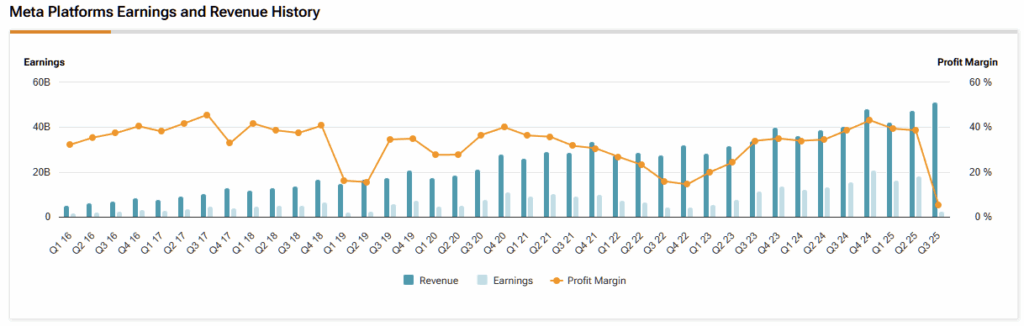

Since Meta Platforms (META) released its Q3 earnings last week, the stock has taken a sharp hit, erasing all its gains since May, with headlines fixating on rising capital expenditures and higher-than-expected expense growth for next year. Yet beneath the noise, the report was stellar — revenue growth reaccelerated, and margins remained robust.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, just months ago, massive AI-driven capex outlays were exactly what investors wanted to see, sending META and other AI beneficiaries to new highs. Now, sentiment appears to have flipped, as those same investments are sparking concerns about overspending. It’s fair to wonder whether the “AI bubble” warnings echoing across markets in recent weeks have started to seep into investor psychology — it certainly looks that way.

To make matters worse, a non-cash tax charge obscured the underlying strength of the quarter, while talk of 2026 CapEx dominated the narrative. Understandably, this pullback feels reminiscent of 2022, reviving fears of a prolonged drag on the stock. For me, those fears are misplaced. I believe Meta is laying the groundwork for long-term growth. The stock accounts for the lion’s share of my portfolio, and I see no reason to doubt the overarching narrative — I’m buying the dip.

Q3 Was Utterly Impressive, Yet Nobody Talks About it

Some skepticism about Meta’s elevated capital expenditures plans is warranted. But what’s surprising is how little attention the market has paid to the company’s underlying performance, which was nothing short of exceptional.

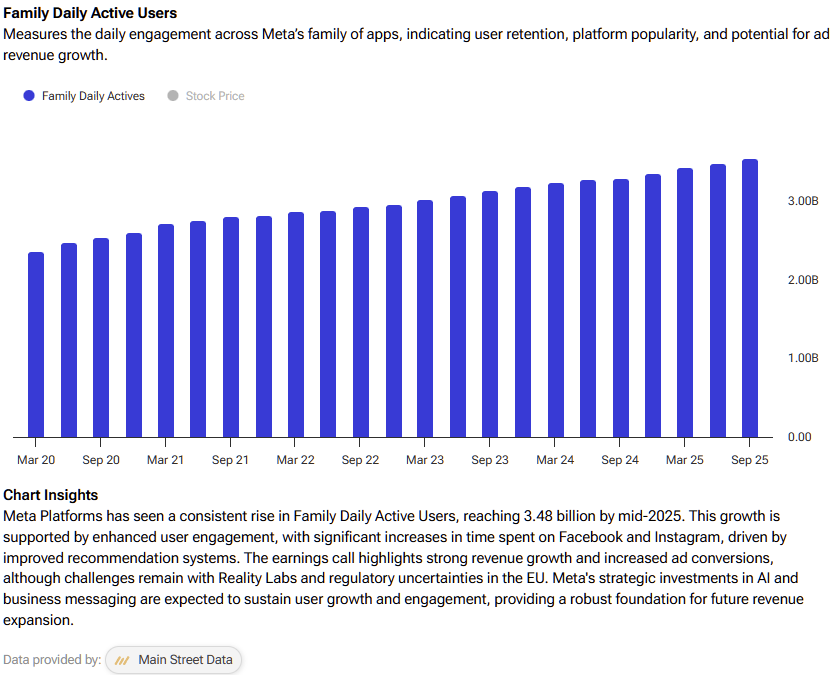

Revenue growth re-accelerated from 22% in Q2 to 26% in Q3. Ad impressions increased 14%, while the average price per ad rose 10% — a rare and highly sought-after combination of expanding supply and higher pricing power. Meanwhile, META user numbers are accelerating 8% year-over-year (up from 6% in Q2) — a staggering figure for a company of Meta’s scale, with ~3.5 billion people using one of its apps every day.

AI-powered recommendations and video engagement were some of the strongest growth drivers behind these metrics. Time spent rose 5% on Facebook and 10% on Threads, while Instagram video time jumped more than 30% year over year. Reels’ monetization engine now runs at a more than $50 billion annual rate, and Meta’s end-to-end automated ad tools (Advantage+) moved past $60 billion. Thus, we know for a fact that AI is really lifting engagement and ad performance.

Product-specific catalysts also performed well, as Instagram surpassed 3 billion monthly active users; Threads reached 150 million; click-to-WhatsApp ad revenue increased by 60%; and Meta is consolidating dozens of ad ranking models into larger, smarter systems (Lattice, Andromeda) that are already boosting conversion and ad quality.

This strategy should become more effective by the day, as these models are being trained on an ungraspable amount of data. The fact that user growth actually accelerated at this stage in Meta’s life is something I don’t think anyone expected, and it serves as proof that these smarter models are working.

Why This Isn’t 2022

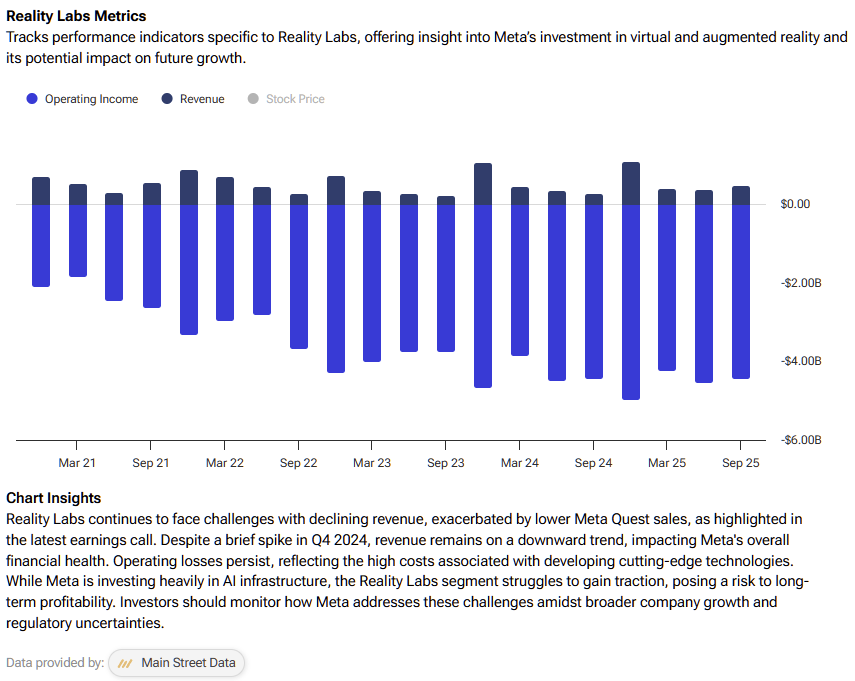

I understand why investors are flashing back to 2022 — when margins compressed, Reality Labs’ losses dominated headlines, and sentiment cratered. That concern isn’t entirely misplaced. Meta raised its 2025 CapEx guidance to $70–$72 billion and noted that 2026 will be “notably larger.” The tone of the earnings call also suggested that Mark Zuckerberg intends to go “all in” on Meta’s VR and AI ambitions — whatever the cost.

However, I think today’s setup is fundamentally different. Meta still delivered a 40% operating margin this quarter — down from 43% last year, but exceptional nonetheless. The EPS miss was entirely due to a one-time, non-cash tax adjustment. And while Reality Labs continues to post sizable losses (about $4.4 billion in Q3), the crucial distinction lies in where the heavy spending is going.

This time, investment is flowing toward compute and AI infrastructure — the very engines driving engagement, targeting, and measurement across Meta’s core advertising business. It’s also funding AI-native products that already have visible traction, including Meta AI, Business AI, and Vibes.

Meanwhile, the hardware narrative is no longer just an expensive science project. The new Ray-Ban Display glasses sold out in 48 hours, and AI-enabled wearables are beginning to make a meaningful contribution to Reality Labs’ revenue — early proof that the market genuinely likes the product.

Yes, the prospect of rising spending next year feels uneasy, especially since the precise amount remains undisclosed. But management’s rationale is sound: Meta is front-loading compute capacity to avoid future bottlenecks. If the timeline for “superintelligence” development stretches out, that capacity can still generate value through improved ad ranking, higher ROI, and flexible scaling. That degree of optionality and monetization potential simply didn’t exist back in 2022.

Valuation: A Growth Engine At A Discount

After the stock’s sharp post-earnings sell-off, I believe Meta is now trading at a significant discount. The shares currently trade around 24x this year’s expected EPS and 21x next year’s estimates. For a company growing revenue in the mid-20% range, with accelerating engagement and clear AI-driven improvements in ad performance, that valuation looks exceptionally attractive.

Moreover, key metrics like Daily Active People (DAP) re-accelerating alongside top-line growth suggest strong momentum heading into Q4. Once the market looks past the near-term noise and refocuses on Meta’s underlying fundamentals, I expect the stock to re-rate higher, supported by both earnings growth and multiple expansion.

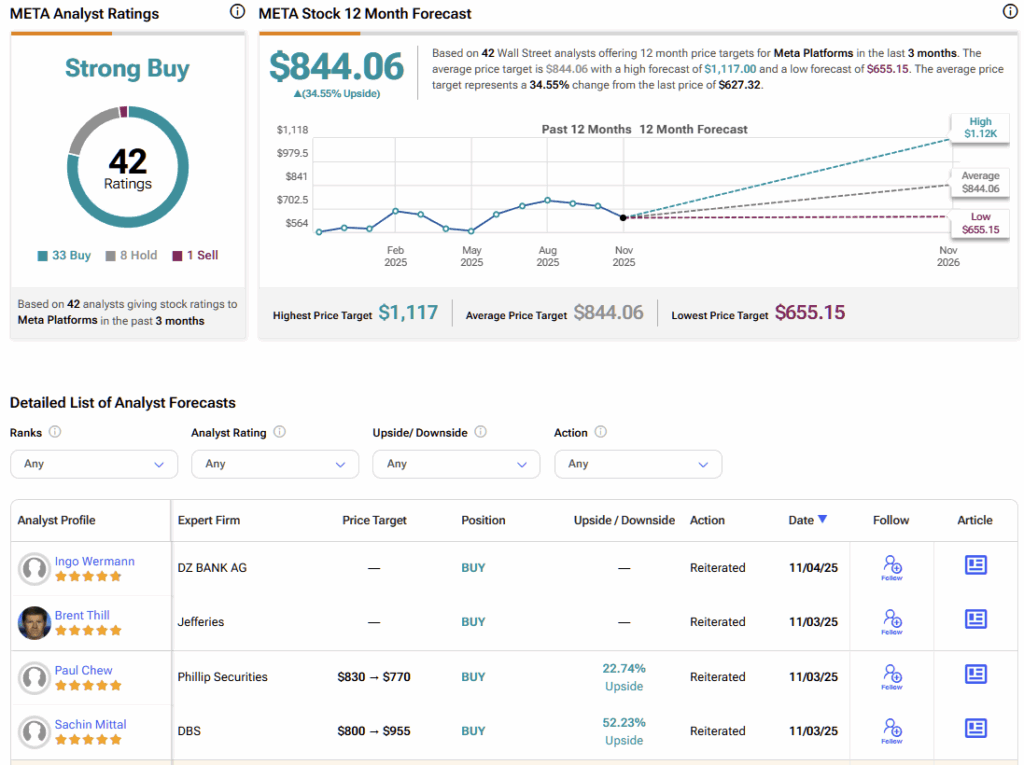

Is Meta Platforms a Buy, Sell, or Hold?

Wall Street remains quite bullish on Meta, despite the violent post-earnings sell-off. The stock now carries a Strong Buy consensus rating based on 33 Buy, eight Hold, and just one Sell ratings over the past three months. In fact, Meta’s average stock price target of $844.06 suggests ~34% upside over the next year.

Why META’s Q3 Proves the Bears Wrong

Overall, while many investors haven’t acknowledged it yet, I believe Meta’s Q3 report was exceptional — but not in an obvious way. It showcased accelerating growth, deeper engagement, and stronger monetization, all fueled by AI-driven performance gains. Although CapEx concerns have revived memories of 2022, today’s investments are focused on scalable AI infrastructure — initiatives that are already demonstrating tangible returns, not speculative moonshots.

With high margins, solid fundamentals, and a valuation near historical lows, Meta’s long-term growth story remains firmly intact. I remain confident in the company’s trajectory — and I’m buying the dip with conviction.