Just days ago, things weren’t looking good for electric bus maker Proterra (NASDAQ:PTRA), which was spiraling downhill after its earnings disappointed. Proterra also had some serious liquidity problems that left investors deeply concerned as well. However, those liquidity problems have been put to rest, and investors are pleased, as the stock is up somewhat in Monday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Proterra amended a section of a Note Purchase Agreement known as the “minimum liquidity covenant.” Said covenant requires Proterra to have four times the cash on hand as it spent in any particular quarter. It actually broke that agreement last quarter by having only $300 million cash after spending $110 million.

The new agreement, meanwhile, calls for just $125 million in cash to be on hand, period. However, for this, Proterra needs to pay not only 5% annual interest but also 7% payment-in-kind interest. Previously, Proterra was paying 5% cash interest but only 4.5% payment-in-kind. The notes also had their shelf life extended, going from being due in August 2025 to August 2028.

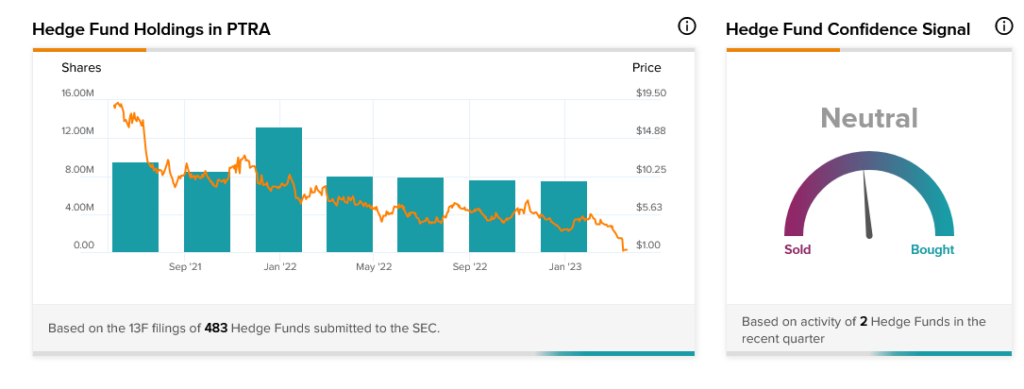

Meanwhile, hedge funds‘ opinion of Proterra is declining as sentiment is on the low side of neutral. Furthermore, hedge funds reduced their Proterra holdings by 100,000 shares in the last quarter.