As President-elect Donald Trump prepares to return to the White House, the noise around his proposed tariffs is rising. To reduce the U.S. trade deficit, the president-elect has proposed a sweeping 10% tariff on all imports and a hefty 60% tariff on Chinese imports

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, according to a Yahoo Finance report, such a proposal could particularly affect discount retailers and footwear makers.

Furthermore, according to the National Retail Federation (NRF), these tariffs could further reduce American consumer spending amid an inflationary environment by $46 billion to $78 billion annually. Furthermore, NRF CEO Matthew Shay warned that across-the-board tariffs would drive inflation, raise prices, and lead to job losses, affecting American families most directly.

Why Could Tariffs Impact Discount Retailers?

These tariffs are likely to impact discount retailers heavily as these retailers source most of their merchandise from China due to the low cost of imports.

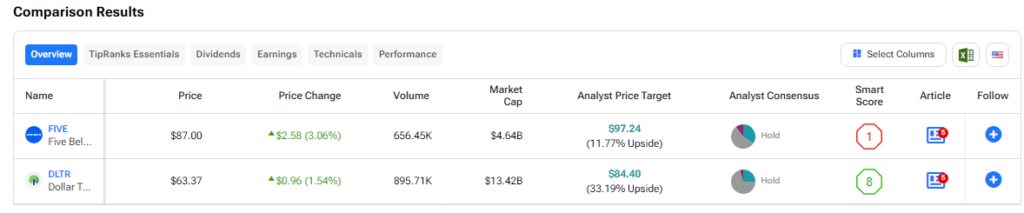

In fact, Arun Sundaram, an analyst at CFRA, explained to Yahoo Finance that companies like Five Below (FIVE), which rely heavily on low-cost imports, will likely be forced to raise prices in response to higher tariffs. Furthermore, Sundaram noted that while Five Below may have some flexibility with its varied price points, dollar stores with fixed prices, like Dollar Tree (DLTR), are more limited in their ability to absorb these costs.

This mix of tariffs and anticipated tax cuts is likely to create inflationary pressure, just as prices were falling for big-ticket items. Overall, general merchandise retailers like Dollar General (DG), particularly those selling apparel, furnishings, and electronics, are expected to feel the impact.

Footwear Companies Could Also Be Heavily Impacted

In addition to discount retailers, footwear companies are facing particularly strong headwinds. Brooks Running CEO Dan Sheridan described the impact of additional tariffs to Yahoo Finance as a “huge headwind,” especially since the industry already contends with tariffs of 20% on Chinese imports and 27% on Vietnamese imports. He noted that businesses would likely pass some of these costs on to consumers, as absorbing the increases would impact research and development budgets.

Matt Priest, the CEO of the Footwear Distributors and Retailers of America (FDRA), told Yahoo Finance, “Our ability to rely on foreign sources is critical, while at the same time, we understand … the incoming Trump administration may find the need to search for ways to protect really critical national security interests.”