Industrial real estate investment trust Prologis (NYSE:PLD) reported another impressive quarter with consistent growth in both top-line and bottom-line results. The company also raised its guidance for the full year of 2023. However, PLD stock declined more than 3% in yesterday’s trading session. The drop can be attributed to investors’ concerns over lower leasing activity and declining fee-related earnings compared to the previous quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

PLD reported Q2 net earnings of $1.83 per share, which easily surpassed the Street’s expectations of $0.98 and increased 60% year-over-year. Meanwhile, the company’s revenues rose about 96% to $2.45 billion. Also, the top line came in higher than the consensus estimate of $1.72 billion.

Moreover, the company said fee-related earnings continued to decelerate in the reported quarter. It declined 7.7% sequentially to $265 million. Also, leasing activity decelerated sequentially to 43.3 million square feet (msf), compared with 46.6 msf in the previous quarter.

Updated Fiscal 2023 Outlook

The company has increased its net earnings guidance for Fiscal 2023, now expecting earnings in the range of $3.30 to $3.40 per share, compared with the previous outlook of $3.10 to $3.25 per share. The consensus estimate for earnings is pegged lower, at $2.80 per share.

Additionally, PLD raised its Core FFO (funds from operations) estimates to a range of $5.56 to $5.60 per share, compared to the prior guidance of $5.42 to $5.50 per share.

Furthermore, Prologis now anticipates its cash same-store net operating income to grow by 9.5% to 10%, up from its previous guidance of 9% to 9.75%.

These upward revisions indicate Prologis’ confidence in its financial performance in the near term.

Is PLD Stock a Buy, According to Analysts?

Following the results, two analysts maintained a Buy rating on PLD stock. Overall. The Wall Street analysts have a Strong Buy consensus rating on the stock. This is based on 14 Buys and two Holds assigned in the past three months. At $142.44, the average Prologis stock forecast suggests 14.87% upside potential.

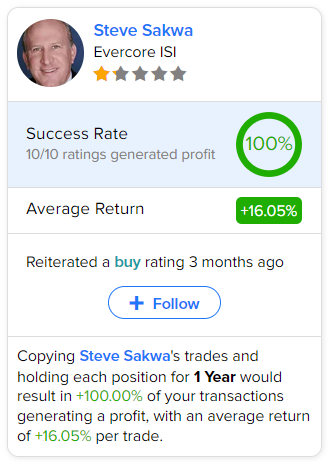

If you’re wondering which analyst you should follow if you want to buy and sell PLD stock, the most accurate analyst covering the stock (on a one-year timeframe) is Steve Sakwa from Evercore ISI, with an average return of 16.05% per rating and a 100% success rate. See below.