Apple (NASDAQ:AAPL) sputtered out of the starting blocks as 2025 commenced, a marked change for the traditional stock market winner. Overall jitters throughout the market and trade worries – especially vis-a-vis China – placed a heavy weight on the company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

All told, Apple’s share price fell almost 30% during the first few months of the year. Things have been improving of late, however, and AAPL has surged upwards by ~50% since hitting a 2025 low in early April.

The company has charged into the fall months going full throttle, recently launching its iPhone 17. Though these models don’t have all of their AI bells and whistles just yet, these features are coming down the pike as well.

This has given top investor James Brumley plenty of confidence in Apple’s ability going forward.

“Apple’s initial dive into the consumer-facing artificial intelligence space was a dud. Its second act is much more promising,” asserts the 5-star investor, who is among the top 1% of all stock pros covered by TipRanks.

Brumley notes that it certainly appears that the iPhone 17 has created a buying frenzy, with major financial firms such as Bank of America and JPMorgan projecting that demand for Apple’s latest and greatest smartphone is “quite strong.”

That’s the case even though not all of its artificial intelligence offerings have been deployed. This includes the new AI-powered Siri (Apple’s digital assistant), slated for release in spring of next year.

“Despite the company’s slow start on this front, the long-term opportunity is still tremendous,” emphasizes Brumley.

To prove the point, the investor cites Straits Research, which predicts that the global market for Apple Intelligence could top $200 billion by 2033. This would translate into an annual growth rate of 32% over the coming years.

With this tailwind at its back, Brumley believes that AAPL is “set to soar in 2025 and beyond.” (To watch James Brumley’s track record, click here)

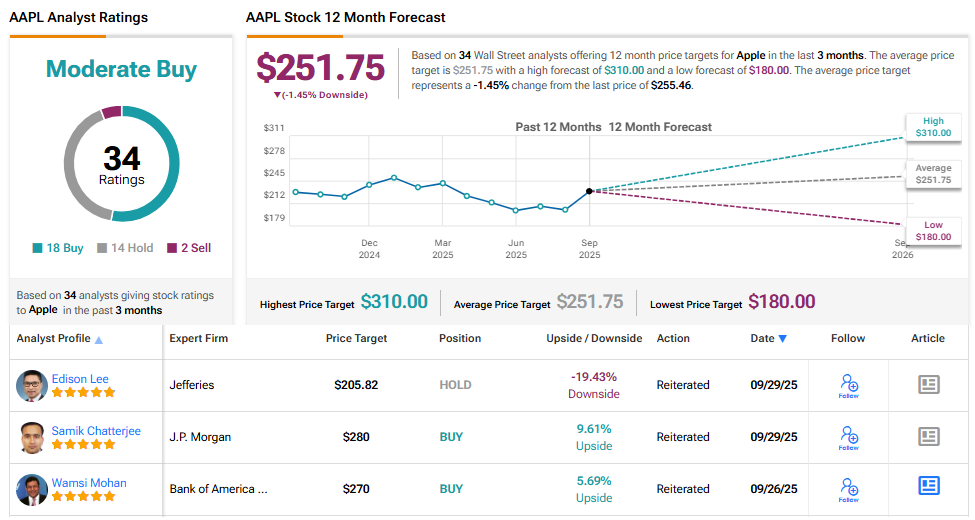

Wall Street has a bit of a mixed view of AAPL’s prospects. With 18 Buys, 14 Holds, and 2 Sells, AAPL enjoys a Moderate Buy consensus rating. Its 12-month average price target of $251.75 implies minimal downward movement in the months ahead. (See AAPL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.