President Donald Trump is expected to sign an executive order on Thursday that would finalize how TikTok will operate in the U.S. According to the reports, China has accepted the U.S.-proposed terms along with all other parties involved in the deal.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It must be noted that Thursday’s executive order will formally declare that the new ownership structure complies with the law. The order is expected to include a 120-day enforcement pause to allow time for the sale to go through.

The agreement, which has been months in the making, will transfer majority control of the app from its Chinese parent company, ByteDance, to a group of American investors.

Importantly, the sale structure is designed to comply with a bipartisan 2024 law that mandated that the platform be sold to U.S.-based owners or face a ban.

A New Chapter for TikTok

Under the proposed structure, TikTok’s U.S. operations will be managed by a newly formed joint-venture company. ByteDance will retain less than 20% ownership, while American firms, including Oracle (ORCL), Silver Lake, and reportedly figures like Larry Ellison, Lachlan Murdoch, and Michael Dell, will hold the majority stake.

Oracle will continue to serve as TikTok’s data and security provider, and the app’s algorithm will be retrained and monitored to prevent foreign influence. U.S. user data will be stored domestically, addressing the national security concerns.

The deal comes after Trump extended the deadline to avoid a TikTok ban multiple times this year. The app was briefly shut down in January, but was reinstated after Trump promised to pursue a negotiated sale with China.

What Is the Best Social Media Stock to Buy?

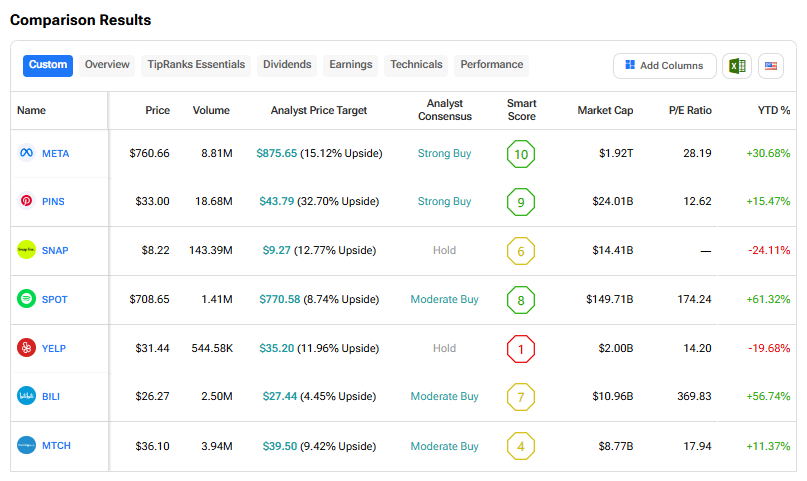

For investors interested in investing in the Social Media sector, we have shortlisted the best stocks to buy in this sector, using the TipRanks Stocks Comparison tool. Analysts are most bullish on Meta Platforms (META) and Pinterest (PINS), both of which carry a Strong Buy rating. Among the two, Pinterest offers the highest upside potential from its current price.