President Trump has continued to criticize Federal Reserve Chair Jerome Powell, even though he recently said he has “no intention” of firing him. In the Oval Office on Wednesday, Trump said he “might call” Powell and repeated his view that the Fed is making a mistake by not cutting interest rates. He believes Powell acted too slowly in the past to fight inflation and called him “too late” to respond. Trump blamed Powell’s appointment on a recommendation made by someone he is now unhappy with and recently called for “pre-emptive rate cuts” in a social media post, while also referring to Powell as a “major loser.”

Although Trump’s comments raised concerns about whether Powell might be removed, he said on Tuesday that he doesn’t plan to fire him, which helped calm investors. However, White House adviser Kevin Hassett confirmed that the administration had looked into whether it was possible to replace Powell. Tensions increased after Powell warned that Trump’s new tariffs could raise inflation and slow the economy, which led the Fed to keep interest rates steady for now. Trump didn’t take that well and responded by demanding immediate rate cuts to avoid an economic slowdown.

While Trump pushes for rate cuts, several Fed officials are warning that it is better to be cautious. Indeed, Cleveland Fed President Beth Hammack said that the smarter option is to “sit and wait” for more data before changing policy. In addition, Minneapolis Fed President Neel Kashkari noted that the bar for cutting rates is higher now, especially with inflation risks from tariffs. Powell has also said the Fed needs to focus on keeping prices stable and is not yet sure if the inflation caused by tariffs will be short-term or long-lasting.

Is SPY a Buy Right Now?

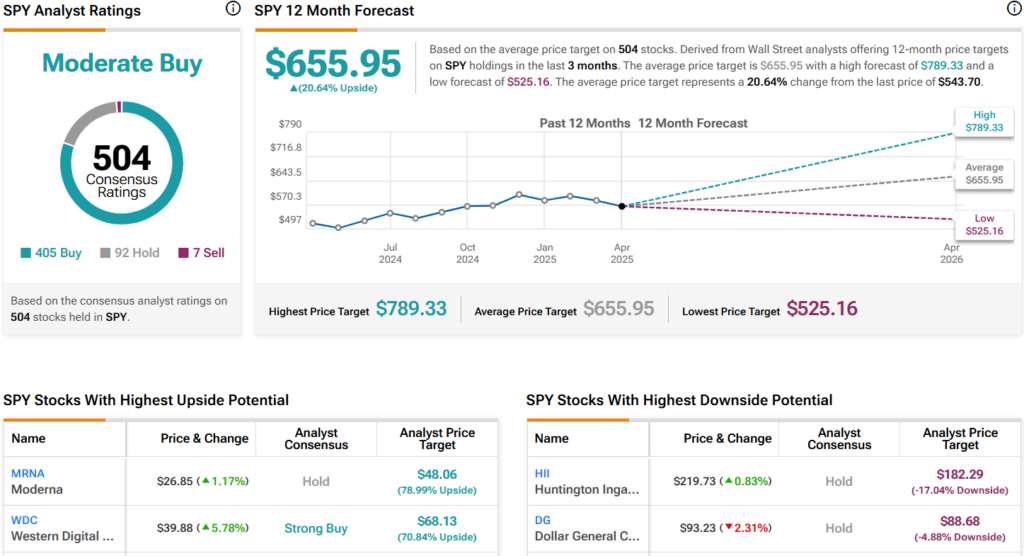

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust (SPY) based on 405 Buys, 92 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $655.95 per share implies 20.6% upside potential.