IonQ (NYSE:IONQ) stock has gone against the grain last week — while most stocks have been losing ground, the quantum computing specialist surged 7% over the past two sessions following a standout Q3 beat-and-raise report. That move adds to an already impressive 168% gain over the past year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The College Park, Maryland-based firm generated revenue of $39.9 million, amounting to a 221.5% year-over-year increase, significantly surpassing the Street’s estimate of $27.9 million and exceeding the top end of its guidance by 37%. Management attributed the strong performance to rising demand across quantum computing, sensing, networking, and cybersecurity applications. At the other end of the spectrum, adj. EPS came in at -$0.17, beating expectations by $0.03.

For the full year, the company now anticipates revenue between $106 million and $110 million, well above the $91.33 million consensus estimate and its prior guide of $82 million to $100 million. IonQ also reaffirmed its adj. EBITDA loss midpoint guidance, with an expected range of a $206 million to $216 million loss.

Additionally, IonQ called attention to several technical milestones in both qubit count and gate fidelity. The company reached #AQ64 (Algorithmic Qubits 64, reflecting effective computational capacity accounting for qubit count and fidelity) on its 100-qubit Tempo system, achieving this three months ahead of schedule, with #AQ64 capable of handling a computational space over 260 million times larger than the previous #AQ36 Forte system. On the fidelity front, IonQ achieved a two-qubit gate fidelity exceeding 99.99%, representing the highest level reported in the industry so far. This milestone was demonstrated on a prototype system utilizing an Electronic Qubit Control (EQC) architecture.

At the same time, the company seemed confident regarding its performance in Stage A of DARPA’s QBI program. Management noted that both IonQ and Oxford Ionics (which IonQ acquired in September) have received positive technical feedback from DARPA.

Scanning the print, Rosenblatt analyst John McPeake hails a “pivotal quarter,” emphasizing the disconnect between consensus forecasts and IonQ’s trajectory. “Street estimates for revenue growth over the period from 2025 to 2030 show almost 8,000bp of deceleration–the Q&A on the call suggested the reverse,” McPeake noted.

The analyst highlights the $2 billion equity raise in October, which increased IonQ’s cash position to more than $3 billion. With an estimated total cash burn of $0.9 billion through 2030 (when it should break even), McPeake believes the company will have sufficient liquidity to support its growth objectives.

“We think investors should own IONQ during this period of acceleration,” McPeake summed up, assigning the stock a Buy rating, while raising the price target from $70 to a joint Street-high of $100. Should the figure be met, investors will be pocketing returns of 69% a year from now.

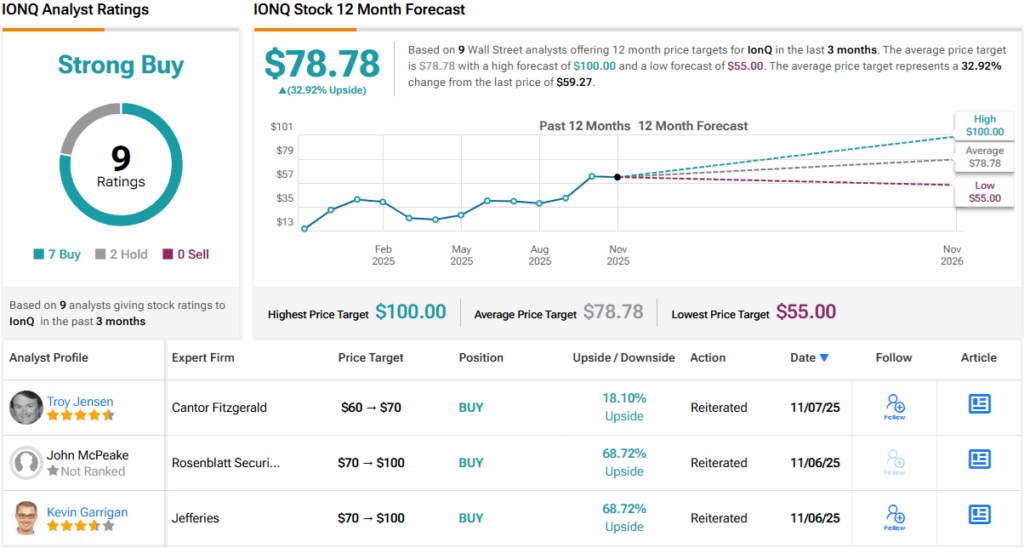

Most analysts agree with the Rosenblatt stance; based on a mix of 7 Buys and 2 Holds, IONQ stock claims a Strong Buy consensus rating. Going by the $78.78 average price target, shares will appreciate by ~33% over the 12-month timeframe. (See IONQ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.