PrairieSky Royalty (TSE:PSK), a company that makes its money from oil & gas royalties across Canada, reported its Q2-2023 earnings results after market close today. PSK’s results could have been better, as both revenue and earnings per share (EPS) missed expectations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Revenues for Q2 2023 reached C$117.4 million, below the expectations of C$120 million but notably lower than last year’s figure of C$198.1 million. Additionally, earnings per diluted share came in at C$0.20 (expectations were C$0.23), below last year’s EPS of C$0.46.

Moreover, funds from operations — known as FFO, a cash-flow metric — for the quarter reached C$91.3 million or C$0.38 per share (43% lower year-over-year).

On a positive note, royalty production grew 3% year-over-year, and the company’s C$0.24 dividend is well-covered, with a payout ratio of 63%.

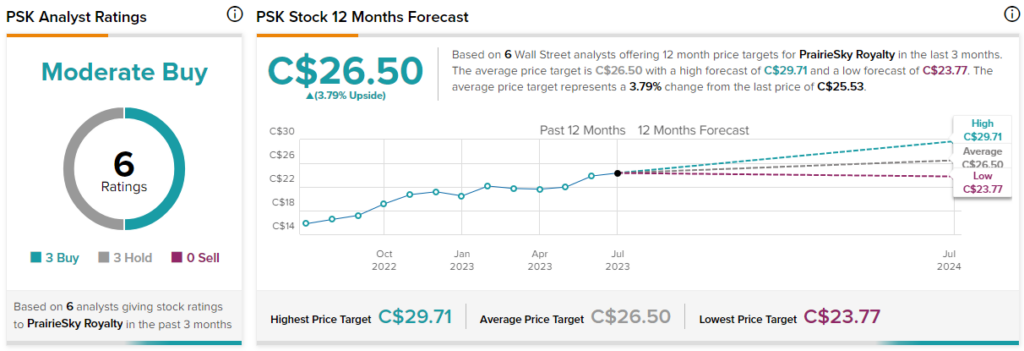

Is PSK Stock a Buy, According to Analysts?

PrairieSky stock has a Moderate Buy consensus rating from analysts based on three Buys and three Hold ratings assigned in the past three months. At $26.50, the average PSK stock price target implies 3.8% upside potential.