Pool Corp. (NASDAQ:POOL), the largest wholesale distributor of swimming pool and associated products globally, has delivered a robust set of third-quarter results. This comes even as consumers tighten their purse strings in the present higher-for-longer interest rate environment. While revenue declined by 9.3% year-over-year to $1.47 billion, the figure still landed better than estimates by $10 million. In addition, EPS of $3.50 came in line with expectations.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It’s also worth noting that this third-quarter sales figure was the second-highest in the company’s history. However, while maintenance activities remained resilient, pool-construction-related activities came under pressure as macroeconomic challenges weighed on consumer spending.

Impressively, gains in working capital helped the company generate $750 million in net cash from operations during the first nine months of 2023. In comparison, it had generated $307.5 million in net cash from operations in the comparable year-ago period. For the full year, POOL expects EPS to land in the range of $13.15 to $13.65.

Is POOL a Good Stock to Buy?

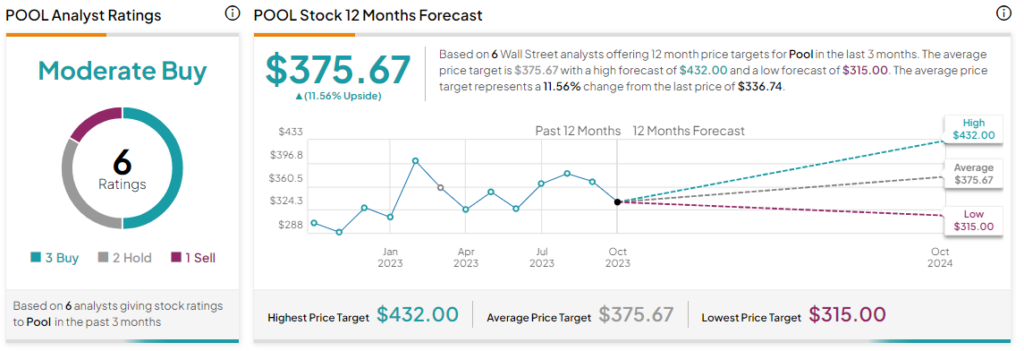

Overall, the Street has a Moderate Buy consensus rating on Pool. The average POOL price target of $375.67 implies a nearly 11.6% potential upside. That’s on top of a nearly 15% rise in the share price over the past year.

Read full Disclosure