Plug Power (PLUG) stock got a boost on Friday from updated analyst coverage. H.C. Wainwright analyst Amit Dayal reiterated a Buy rating for the hydrogen and zero-emissions fuel cell solutions company’s shares. Even more interesting, the analyst bumped up his price target for PLUG stock to $7 per share from $3 per share. This suggests a possible 107.72% upside for PLUG shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Dayal cited a few reasons for his bullish Plug Power rating and price target. The analyst noted “significant” increases in electricity prices over the past few months as one of the reasons for this change. He also pointed to growing regulatory support and consumer demand for nuclear power as another reason for the increased PLUG stock price target.

The H.C. Wainwright analyst’s coverage of Plug Power stock also highlighted a high short interest in PLUG shares, sitting at more than 30%. This suggests that the stock’s current price could be weighed down by short sellers and doesn’t reflect its true value. That also helps explain why Dayal increased his price target for PLUG stock.

Plug Power Stock Movement Today

Plug Power stock was up 25.8% on Friday, extending a 65.02% rally year-to-date. Investors will also keep in mind that PLUG shares have soared 31.63% over the past 12 months. Today’s rally came with some 7 million shares traded, compared to a three-month daily average of about 80.68 million units.

Is Plug Power Stock a Buy, Sell, or Hold?

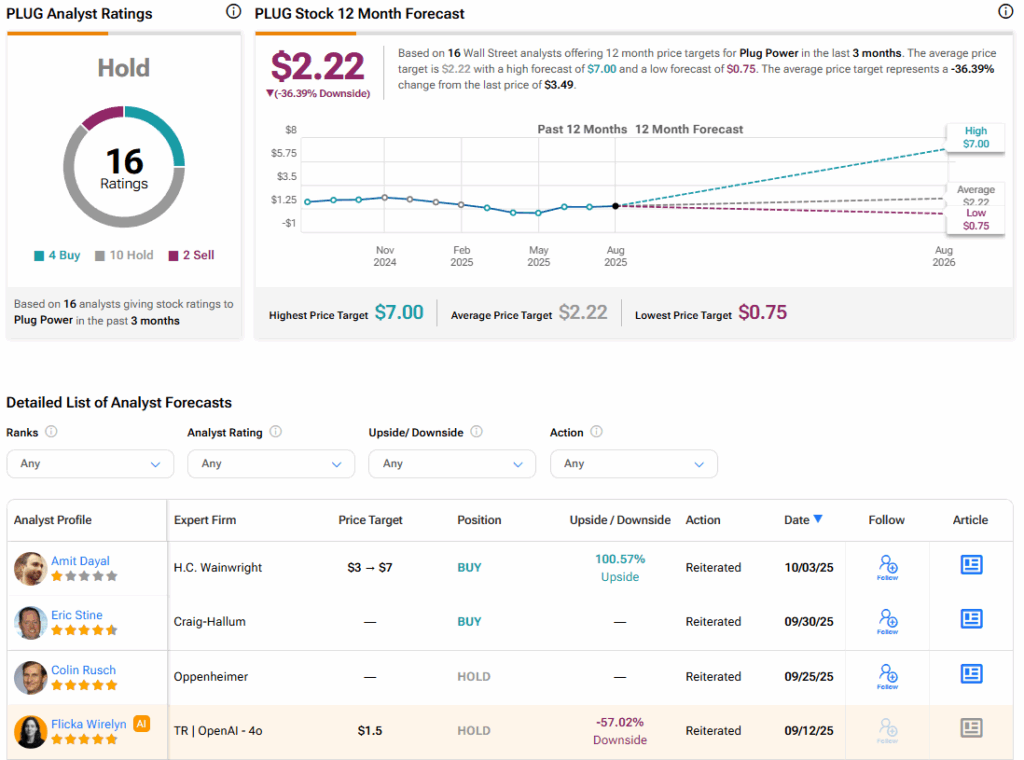

Turning to Wall Street, the analysts’ consensus rating for Plug Power is Hold, based on four Buy, 10 Hold, and two Sell ratings over the past three months. With that comes an average PLUG stock price target of $2.22, representing a potential 36.39% downside for the shares.