While Enbridge (TSE:ENB) (NYSE:ENB) mainly focuses on oil pipelines, it’s also been moving toward wind energy. In some places, more so than others. That odd preference in geography has left investors a bit skeptical, and Enbridge shares are down fractionally in Thursday afternoon’s trading as a result.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Right now, Enbridge is looking to put its investments in offshore wind generation into France rather than the United States. The reason? Mounting costs and supply chain issues have made United States offshore wind projects a lot less welcoming and rewarding than their French counterparts. While this won’t exactly be a huge hit to anyone—Enbridge’s wind business is roughly 3% of its earnings before interest, taxes, depreciation, and amortization (EBITDA)—it’s still a blow nonetheless.

And the Pipelines aren’t Looking Great, Either

While Enbridge’s decision to put the United States on the back burner might have been bad enough, it comes at a terrible time. Enbridge’s Line 5 pipeline—which runs from Canadian oil fields to a refinery in Sarnia, Ontario—has long been controversial. That’s largely because said pipeline runs right through Lake Superior, the largest freshwater lake by area on the planet. There’s an increasing call for it to be shut down, with some calling on the Biden administration to do the job as Michigan Attorney General Dana Nessel has tried to do on at least one occasion. Shorting the United States’ wind development might not help Enbridge’s case here, especially in an election year.

Is Enbridge a Buy, Sell, or Hold?

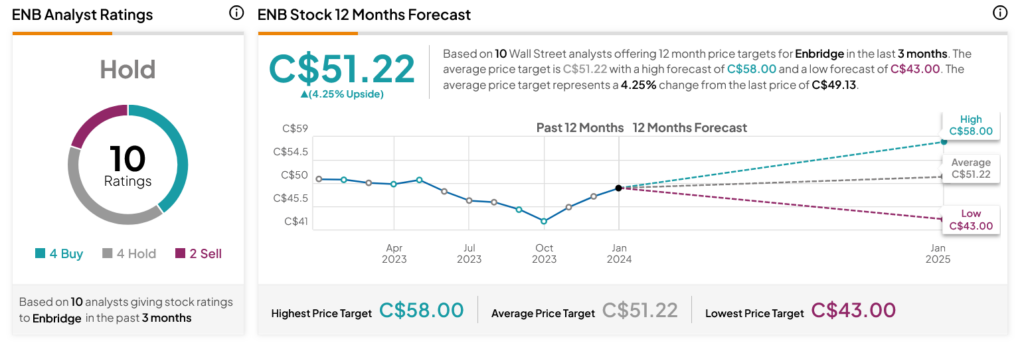

Turning to Wall Street, analysts have a Hold consensus rating on ENB stock based on four Buys, four Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 5.88% loss in its share price over the past year, the average ENB price target of C$51.22 per share implies 4.25% upside potential.