Shares of satellite imagery and geospatial solutions provider Planet Labs (NYSE:PL) are plummeting today after its first-quarter numbers failed to impress investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue rose 31.3% year-over-year to $52.7 million and was largely in line with estimates. Net loss per share at $0.07 too came in narrower than expectations by $0.02. Further, its end-of-period customer tally rose 9% over the prior year to 903 while the percent of recurring annual contract value (ACV) in Q1 stood at 93%.

Looking ahead, for the second quarter, Planet Labs sees revenue hovering between $53 million and $55 million. Adjusted EBITDA loss is expected between $20 million and $17 million.

For fiscal 2024, the company expects revenue to hover between $225 million and $235 million. Adjusted EBITDA loss is anticipated between $67 million and $58 million. The Street though was looking for a revenue of $257 million for the year. Consequently, investor sentiment in the stock is taking a hit in the early session today.

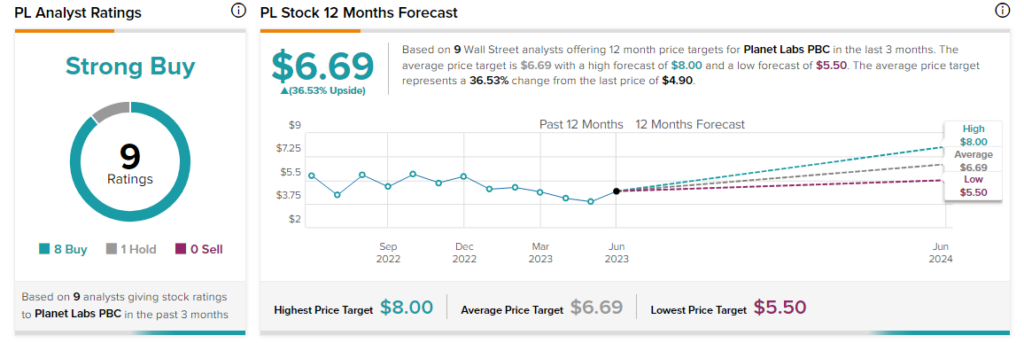

Overall, the Street has a $6.69 consensus price target on Planet Labs alongside a Strong Buy consensus rating.

Read full Disclosure