Piper Sandler Companies (NYSE: PIPR) has inked a deal to acquire Stamford Partners LLP. Following the news, shares of the company lost 7.2% on January 5 to close at $171.60.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Piper Sandler Companies is a U.S.-based independent investment bank and financial services company with a focus on mergers and acquisitions, financial restructuring, public offerings, and other related services. Markedly, shares have risen 65% over the past year.

Benefits of the Deal

Based in London, Stamford Partners is an M&A boutique firm specializing in offering high-quality investment banking services to European food & beverage and related sectors.

The acquisition will add industry-leading European Food & Beverage advisory capabilities to Piper Sandler’s existing Consumer Advisory business. Furthermore, it will strengthen its position in European investment banking capabilities.

The acquisition is expected to close in the first quarter of 2022, subject to certain regulatory approvals.

Management Weighs In

James Baker, Global Co-Head of Investment Banking at Piper Sandler, commented, “Stamford Partners offers differentiated, best-in-class M&A advisory services tailored to the unique needs of clients in the European consumer industry.”

He further added, “The addition is complementary to our existing consumer practice and creates significant opportunities to further expand our reach in partnership with them.”

Analysts Recommendation

On December 21, Northland analyst Mike Grondahl increased the price target on Piper Sandler to $185 (7.8% upside potential) from $175 and reiterated a Buy rating.

Ahead of Piper Sandler’s upcoming earnings for the fourth quarter scheduled for February 3, 2022, Grondahl believes Piper continues to witness “strong M&A trends” with robust trends in Advisory and decent trends in Capital Markets as well. Therefore, he expects Q4 to be a “solid quarter” with results “inline to better” than expectations.

Overall, the stock has a Strong Buy consensus rating based on 4 unanimous Buys. The average Piper Sandler price target of $194.75 implies 13.5% upside potential from current levels.

Bloggers Weigh In

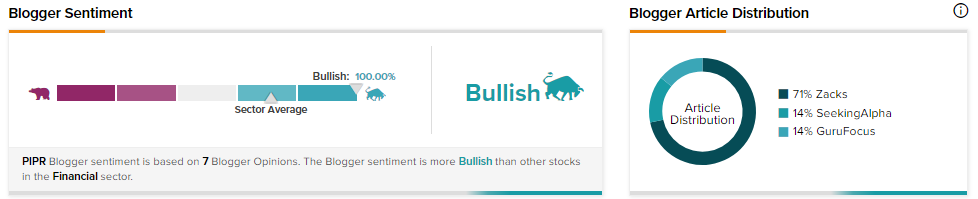

TipRanks data shows that financial blogger opinions are 100% Bullish on PIPR stock, compared to a sector average of 71%.

Download the TipRanks mobile app now

Related News:

Toyota Beats GM in 2021 U.S. Auto Sales; Shares Glide 6.9%

Google Snaps up Siemplify for $500M – Report

Carrier Declares Accelerated Share Repurchases Worth $500M; Shares Rise