Few other names have been as synonymous with the personal computer revolution as Microsoft (NASDAQ:MSFT). A market leader throughout the Internet age, along the way Microsoft has transformed itself into one of the biggest and most influential companies in the world.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As the world transitions into the era of AI, Microsoft remains at the forefront, strategically positioning itself to steer the course of personal computing’s future. The company’s recent unveiling of Copilot+ PCs at the annual Microsoft Build conference solidifies this commitment.

Touted as “the fastest, most intelligent Windows PCs ever built,” these devices mark another milestone in Microsoft’s ongoing journey of pushing boundaries and shaping tomorrow’s technology landscape.

Scheduled for release next month through Microsoft and its manufacturing partners, the Copilot+ PCs will offer users their own personal on-device AI assistant, as well as AI-powered image creation and a recall option that will help review past activity, among other tools.

Microsoft is banking that the new features will convince users to buy these new and improved PCs. Piper Sandler analyst Brent Bracelin believes that they very well could be.

“The new Copilot+ PC unveiling that bundles Windows 11, multi-modal models like GPT-4o supporting voice and text, and advanced hardware specifications could be compelling enough (perhaps) to spark a long-anticipated PC upgrade cycle,” Bracelin opined.

Bracelin believes that the new AI offerings have the potential to spark large-scale purchases among the “1.4 billion people that are still using an aging fleet of Windows devices monthly.”

Considering the massive base of PC users, this could translate into significant profits “with every 3% uplift to Windows revenue adding an estimated $0.05 to EPS,” the analyst writes.

To this end, Bracelin rates MSFT shares an Overweight (i.e. Buy), with a 12-month price target of $465, suggesting an ~8% upside from current prices. (To watch Bracelin’s track record, click here)

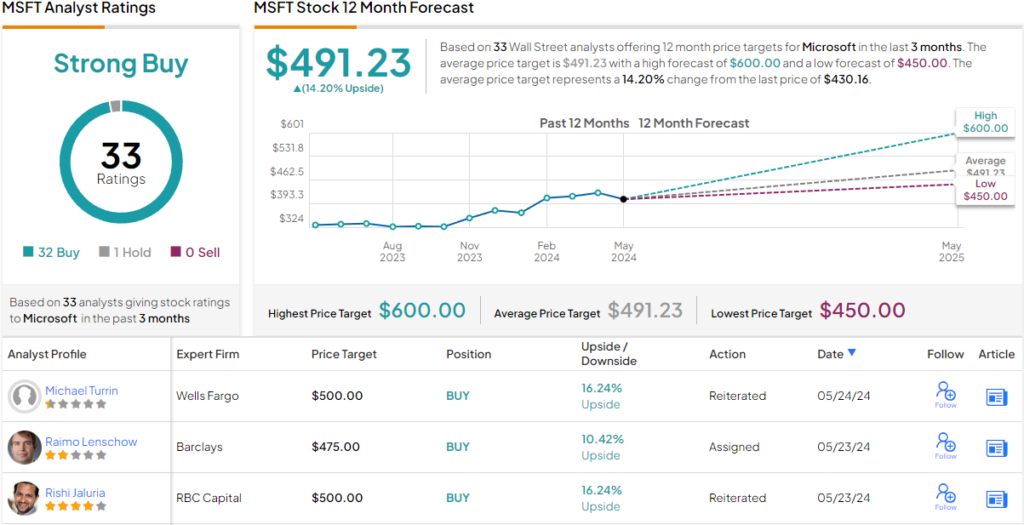

Bracelin’s optimism is handily reflected by his peers on Wall Street. With 32 Buys and 1 Hold, the message is clear: Microsoft is a Strong Buy. The average price target is currently standing at $491.23, implying a ~14% upside for the next 12 months. (See MSFT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.