Shares of Pinterest (NYSE:PINS) surged 5% at the time of writing amid positive analyst comments. Monness, Crespi, Hardt, an investment firm, anticipates sustained user growth from the e-commerce-focused social platform when it reports earnings on August 1. According to analyst Brian White, who holds a neutral stance on Pinterest shares, the company is projected to close the period with a total of 469 million monthly active users, an 8% increase year-over-year. This includes around 96 million users from the U.S. and Canada. He mentioned in an investor note that this 8% growth denotes a slight upturn from Q1’s 7% increase and is a significant leap from the 5% drop observed in the same quarter last year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

White highlighted a series of positive moves by the company, including enhanced advertiser support, an improved user experience, and the planning of its inaugural investor day in September. These steps are commendable, even amid a fiercely competitive environment. Nevertheless, he stresses that Pinterest’s strategies and execution will be crucial. He concluded, “In a more stable digital ad market, we expect Pinterest’s Q2 results and Q3 forecast to largely hinge on its execution.”

Is PINS a Good Stock to Buy?

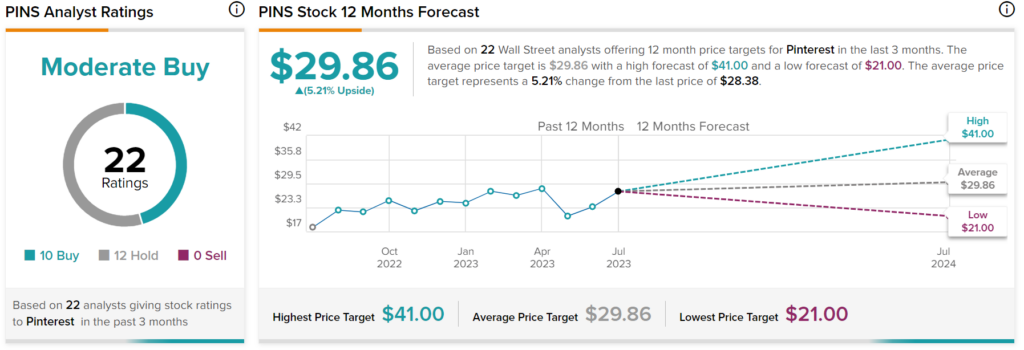

Overall, analysts have a Moderate Buy consensus rating on PINS stock based on 10 Buys, 12 Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $29.86 per share implies an upside potential of only 5.21%.