Pinterest stock gained 11.7% in pre-market trading on Feb. 5 as its 4Q earnings beat Street estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The social media company reported 4Q non-GAAP diluted EPS of $0.43, which came in ahead of analysts’ estimates of $0.32. Revenue in the fourth quarter grew by 76% year-on-year to $706 million, beating consensus estimates of $645.6 million. The company’s global monthly active users (MAUs) grew 37% year-on-year to 459 million.

Pinterest’s (PINS) CFO and Head of Business Operations, Todd Morgenfeld, said, “Q4 capped a remarkable year of growth for Pinterest. Continued product innovation, execution and an earlier and longer holiday season helped us deliver 76% year-over-year revenue growth. As we start 2021, we’ll be building on this momentum by continuing to invest in the success of our advertisers as well as a first-class Pinner experience around the globe.”

The company stated that considering the uncertainty due to the COVID-19 pandemic and other factors, it believes its revenue in 1Q will grow in the low 70% range year-on-year. (See Pinterest stock analysis on TipRanks)

On Feb. 4, just before the earnings announcement, Monness Crespi Hardt analyst Brian White reiterated a Hold rating on the stock. White said in a research note, “As digital advertising spending continues to rebound and Pinterest pulls new growth levers, we believe the company has positioned itself well to benefit from this recovery with a unique franchise in the consumer internet world and an attractive value proposition for advertisers.”

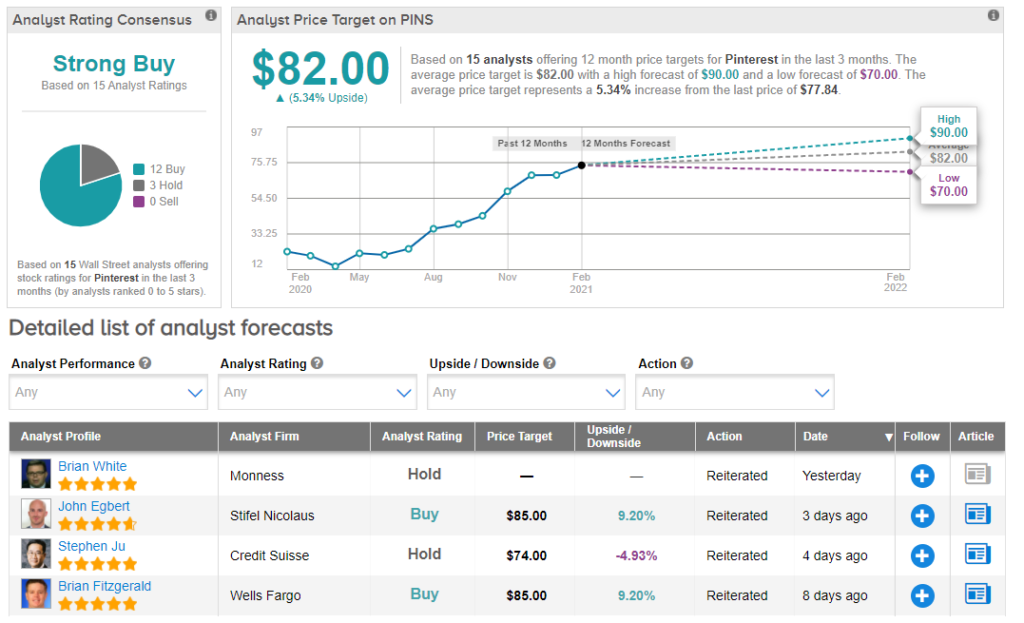

The rest of the Street is bullish about the stock with a Strong Buy consensus rating. That’s based on 12 analysts suggesting a Buy and 3 analysts recommending a Hold. The average analyst price target of $82 implies a 5.3% upside potential to current levels.

Related News:

CoreLogic Snapped Up For $6B By Stone Point Capital and Insight

Snap Faces A Challenging 1Q; Shares Drop 7.5% After-Hours

Qualcomm Drop 5.2% Pre-Market As Chip Supply Constraints Affect Sales