Pinterest shares (NYSE:PINS) are on a roll today, thanks to a rating upgrade from Wells Fargo analysts. Moving from an “Equal-Weight” to an “Overweight” rating, the analysts, led by Ken Gawrelski, even hiked the price target by almost 1.5 times to $34 per share. The main trigger seems to be the strategic alliance that Pinterest has recently formed with Amazon (NASDAQ:AMZN). The aim is to boost user engagement and ratchet up ad load, a move that could drive revenue growth beyond what the market currently expects.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The analysts estimate that a 10% uptick in Pinterest’s international revenue per user every month could lead to a 2% boost in revenue and a 4% increase in EBITDA in 2024. For overall revenue, they expect a 2% rise in 2023 and a 6% surge in 2024. Additionally, they foresee Pinterest’s adjusted EBITDA to reach $577 million and $835 million for 2023 and 2024, respectively.

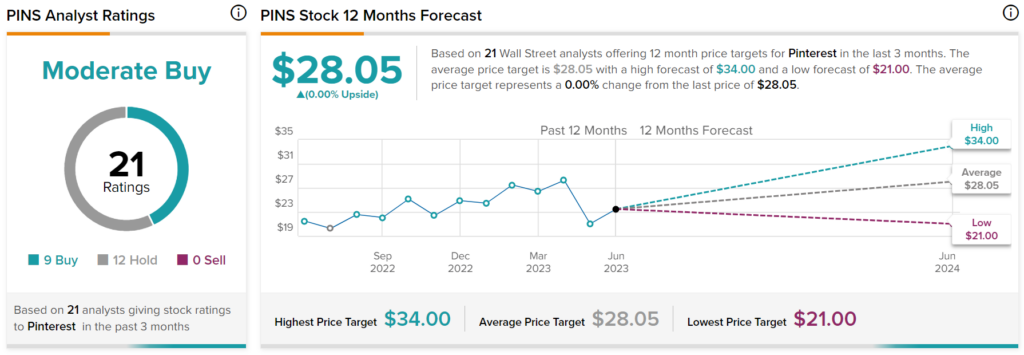

Overall, analysts have a Moderate Buy consensus rating on PINS stock based on nine Buys, 12 Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $28.05 per share implies that the stock is fairly valued.