It should have been a winning day for healthcare properties manager Physicians Realty Trust (NYSE:DOC). However, it’s down almost 2% in Monday afternoon’s trading session, despite an impressive earnings report and a planned merger.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The earnings report posted turned out to be a welcome development. Its third quarter earnings were pretty much a match for analysts’ consensus estimate, and revenue turned out to be a slight beat. Revenue came in at $138.5 million against projections calling for $136.3 million. That’s also up from both the second quarter and 2022’s third quarter, with those numbers coming in at $135.1 million and $131.5 million, respectively.

But what seems to have weighed on Physicians Realty Trust sufficiently to not only wipe out premarket gains but also turn the stock into the red was the merger between itself and Healthpeak Properties. The combined force was executed via an all-stock transaction, and once completed, will produce a company with a combined portfolio of real estate that amounts to around 52 million square feet. That includes 40 million square feet of outpatient offices and around 12 million square feet for lab space. The deal is expected to close sometime before July 2024.

Is DOC Stock a Good Buy?

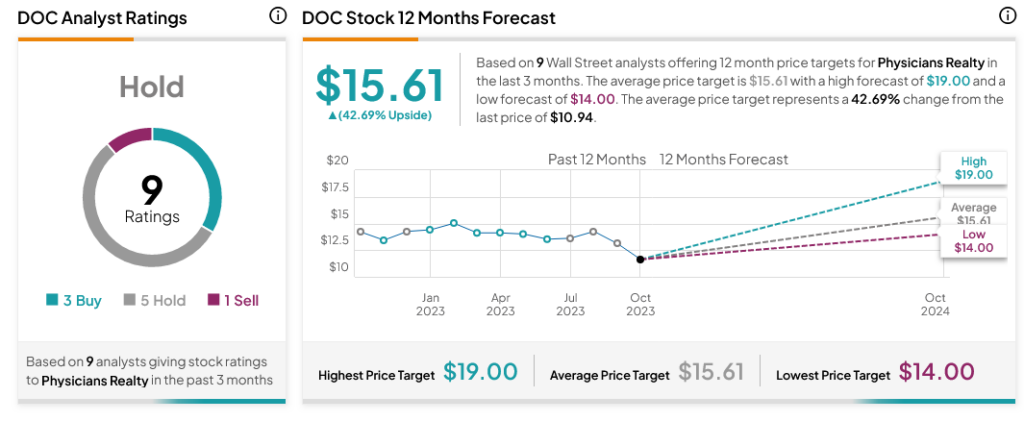

Turning to Wall Street, analysts have a Hold consensus rating on DOC stock based on three Buys, five Holds and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average DOC price target of $15.61 per share implies 42.69% upside potential.