Phreesia, Inc. (PHR) reported mixed second-quarter results for Fiscal 2022, topping revenue estimates but falling short of earnings expectations.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Notably, shares of the software-as-a-service company that offers healthcare organizations a set of applications to manage the patient intake process have gained over 110% over the past year. (See Phreesia stock charts on TipRanks)

Revenues jumped 46% year-over-year to $51 million and exceeded consensus estimates of $47.09 million. The increase in revenues reflected a 19% surge in the average number of provider clients, as well as higher average revenue per provider client, which increased 14%.

However, the company reported an adjusted loss of $0.48 per share, lagging analysts’ expectations of a loss of $0.13 per share. The company reported a loss of $0.17 per share in the prior-year period.

Phreesia CEO Chaim Indig commented, “Throughout our second quarter of Fiscal Year 2022, we again helped our clients drive patient self-service on our platform through the use of tools like mobile check-in, appointment self-scheduling and online payments.”

Looking ahead, the company raised its Fiscal 2022 revenues guidance. The company now forecasts revenues in the range of $195 – $198 million, while the consensus estimate is pegged at $193 million. The company previously guided for Fiscal 2022 revenue in the range of $191 – $194 million.

Ahead of the Q2 results, Canaccord Genuity analyst Richard Close initiated coverage on Phreesia with a Buy rating and the price target of $81 (16.6% upside potential).

Consensus among analysts is a Strong Buy based on 10 Buys and 1 Holds. The average Phreesia price target of $69.95 implies that the shares are fully valued at current levels.

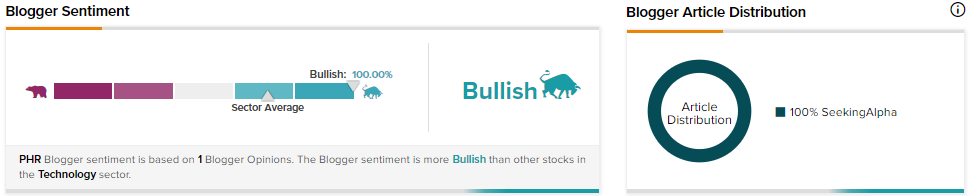

TipRanks data shows that financial blogger opinions are 100% Bullish on PHR, compared to a sector average of 71%.

Related News:

Futu Holdings Reports Strong Q2 Results, Several Milestones Achieved

NIO Lowers Third Quarter Delivery Outlook; Shares Plunge 4%

Walmart Plans to Hire 20,000 New Supply Chain Associates