Insurance and retirement giant Phoenix Group (GB:PHNX) reported its interim results with record performance – as CEO Andy Briggs said the company is ‘ready to look’ for its next takeover deal.

The company reported a solid £950 million of cash generation during the period.

With a huge pile of cash, it rewarded shareholders with an interim dividend of 24.8p per share, a 3% increase over last year.

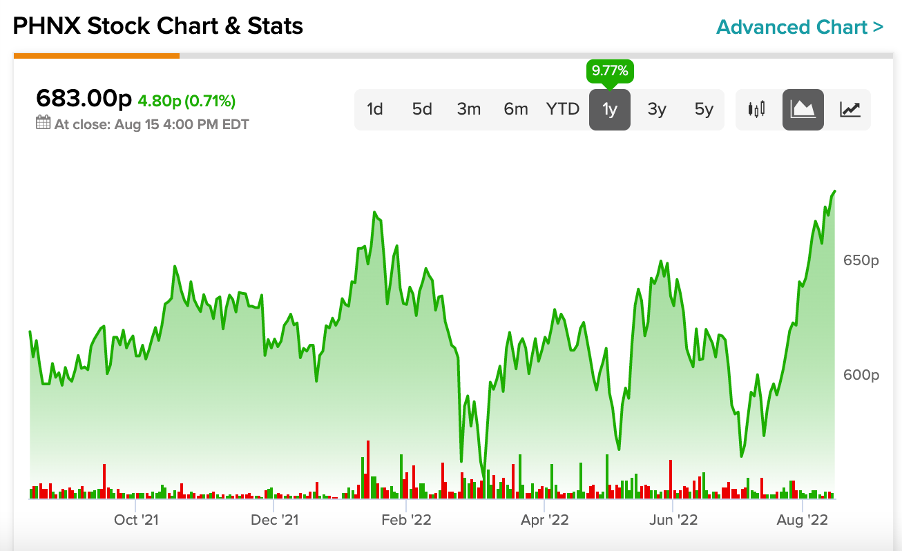

Shares were trading marginally up by 0.71% on Monday. Even with a lot of volatility in its share prices, the stock has managed to stay in the green with an almost 10% return in the past year.

Earlier this month, Phoenix bought Sun Life UK, the British arm of Sun Life Financial (GB:0VJA) for £248 million in cash.

What does the Phoenix group do?

Phoenix Groups deals in a wide range of insurance, pensions, and retirement solutions.

The company’s revenue grew by 28% to £2.69 billion, mainly pushed by its pension deals. It posted an IFRS operating profit of £507 million, which was slightly down from last year’s £527 million. Phoenix Group reported an IFRS statutory loss after tax of £876 million, mainly due to risk hedging to protect its capital and cash.

The company’s strong cash position was boosted by its new business cash generation of £430 million, driven by bulk purchase annuities in its retirement segment.

The company has maintained its solvency II surplus of £4.7 billion and its solvency ratio increased by 6 points to 186%. This gives the company enough scope to invest in organic as well as inorganic growth.

Is Phoenix Group Holdings a good investment?

According to TipRanks’ analyst rating consensus, Phoenix Group stock is a Moderate Buy. That’s based on six ratings from the analysts, which include three buy, and three hold recommendations.

The average price target is 723p, which is 5.8% up from the current price level. The analyst price targets range from a low of 618p per share to a high of 825p per share.

Conclusion

The company has already hit many financial milestones with its first-half results. It is expected to deliver its cash at the higher end of the target range of £1.3 billion to £1.4 billion.

The Phoenix Group is optimistic about the rest of the year, as it will continue to gain from retirement markets, pensions and savings, and more acquisitions down the line.