Proving the recent speculations right, Philip Morris International Inc. (NYSE: PM) made a public offer to acquire Swedish Match AB (GB:0GO4) for cash valued at Swedish Krona (SEK) 106 per share for a total consideration of SEK 161.2 billion (equivalent to $16 billion).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, the board of Swedish Match recommended its shareholders accept the bid of SEK 106 per share, which is supported by a fairness opinion provided by SEB Corporate Finance.

Through the deal, Philip Morris International aims to expand into alternative tobacco products and boost its exposure to the rapidly growing market for smoke-free products amidst heightened global scrutiny and regulations on the sale of traditional cigarettes.

Philip Morris International (PMI), with a market capitalization of $155 billion, is a leading international tobacco company focused on delivering a smoke-free future and evolving its portfolio for the long term to include products outside of the tobacco and nicotine sector.

Following the news, Shares of Swedish Match traded close to the offer price at SEK 103.45, while Philip Morris International shares traded a little higher during the pre-market session.

Details of the Offer

Headquartered in Sweden, Swedish Match develops, manufactures, and sells market-leading quality products with brands in the product segments Smokefree, Cigars, and Lights. The company’s production is located in seven countries, with the majority of the sales coming from the US and Scandinavia.

Interestingly, before the offer, Swedish Match had a market capitalization of around $12 billion (117 billion Swedish krona).

Last year, Swedish Match delivered double-digit growth in sales, driven by its smoke-free division in the U.S., its largest market, and its main product, ZYN nicotine-pouch.

The deal price implies an almost 40% premium to the closing share price of SEK 76.06 on May 9, as well as the volume-weighted average trading price of SEK 75.86 during the last 30 trading days.

The offer, expected to commence on June 23, will expire on September 30, 2022.

The completion of the offer is subject to certain conditions, including Philip Morris owning more than 90% of the total number of outstanding shares in Swedish Match.

Expected Synergies from the Deal

In 2019, the U.S. Food and Drug Administration (FDA) approved Swedish Match to market its General Snus smokeless-tobacco products as they have a lower risk of mouth cancer, heart disease, and lung cancer compared to cigarettes.

The addition of Swedish Match products will lead to the creation of an attractive smoke-free product portfolio globally, tapping into the potentially growing U.S. smoke-free market.

In addition, Philip Morris plans to develop Swedish Match’s oral nicotine portfolio in the U.S. and drive accelerated global expansion opportunities by utilizing PM’s international commercial infrastructure and financial resources.

The deal is expected to be immediately accretive to earnings and cash flows and will lead to a sturdy balance sheet and leverage of approximately 3x net debt to adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) at closing.

CEO’s Comments

Sharing his excitement over the deal, Philip Morris CEO, Jacek Olczak, commented, “Underpinned by compelling strategic and financial rationale, this combination would create a global smoke-free champion—strengthened by complementary geographic footprints, commercial capabilities, and product portfolios—and open up significant platforms for growth in the U.S. and internationally.”

He further added, “Swedish Match’s dedicated employees and management have steadfastly pursued the company’s vision of a world without cigarettes, while delivering very strong results. We look forward to building upon this success and joining forces to accelerate our shared smoke-free mission.”

Wall Street’s Take

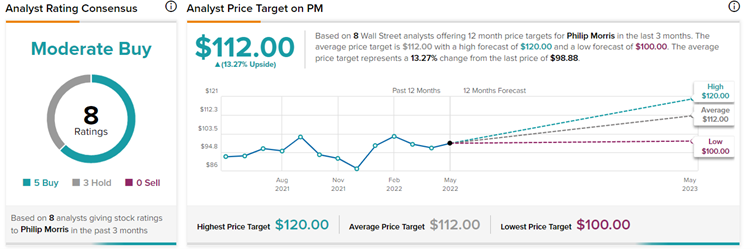

Yesterday, in anticipation of the offer after Philip Morris gave confirmation that discussions are in progress with Swedish Match AB, Morgan Stanley analyst Pamela Kaufman reiterated a Buy rating and price target of $112 (13.3% upside potential) on Philip Morris.

Kaufman foresees a number of strategic benefits from the deal, which include helping Philip Morris achieve its target of generating 50% of revenue from smoke-free products by 2025; diversifying its portfolio to other smoke-free alternatives; and gaining access to US distribution, especially by having access to a leading brand like Zyn in the fast-growing nicotine pouch space.

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on five Buys and three Holds. The average Philip Morris price target of $112 implies 13.3% upside potential to current levels.

Bottom-Line

Like many of its peers, Philip Morris International is aggressively exploring new avenues for revenue generation to move away from the traditional cigarettes and the dampening sales over the last couple of years.

Swedish Match generates around 67% of its revenue from smoke-free products, including snus and nicotine pouches. Therefore, with the takeover, Philip Morris will meet its target of 50% revenue from smoke-free products in a faster and more efficient way.

The acquisition of Swedish Match will be a great strategic fit and boost Philip Morris’s revenues and profits manifold.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Will Philip Morris Acquire Swedish Match AB?

BioNTech Q1 Sales & EPS Grow 3x; Shares Up 3.1%

Despite Exceeding Q1 Expectations, Cano Health Shares Plunge 8.9%