Philip Morris (NYSE:PM) shares are trending marginally lower today after the tobacco and smoke-free products major delivered a mixed third-quarter performance. Despite a nearly 14% jump, its revenue of $9.14 billion fell short of expectations by $80 million. However, the firm’s EPS of $1.67 comfortably beat estimates by $0.06.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While combustible product sales remained resilient, IQOS and ZYN delivered robust growth. Importantly, net revenue from smoke-free products surged by 35.6% over the prior year to $3.3 billion, indicating that the company’s focus on a smoke-free future is paying off. Further, the total number of IQOS users rose to 27.4 million, and the shipment volume of ZYN nicotine pouches rose by 65.7% to 105.4 million cans in the U.S.

Buoyed by this performance, PM raised its adjusted EPS expectations for the full year to a range of $6.58 to $6.61. In addition, net revenue is anticipated to rise by nearly 8% on an organic basis.

Is PM a Good Stock to Buy?

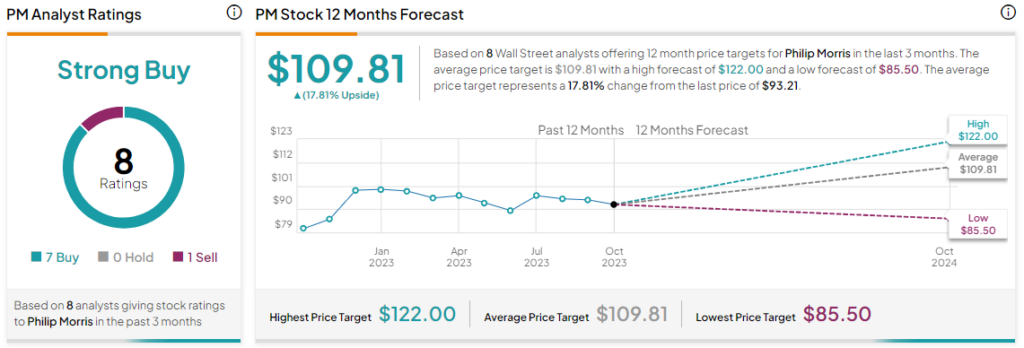

Overall, the Street has a Strong Buy consensus rating on Philip Morris. The average PM price target of $109.81 implies a nearly 18% potential upside. That’s on top of a nearly 8% gain in the share price over the past year.

Read full Disclosure