For healthcare stock Pfizer (NYSE:PFE), it hasn’t exactly been a great month or so. With its COVID-19-related sales on the decline and not much else looking to be the next big star, there’s not much going on for the stock right now. Indeed, that’s a point not lost on UBS, who started coverage and sent Pfizer down significantly in Friday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

UBS started coverage and assigned Pfizer a Hold rating, putting the price target at $34. Essentially, the issue for Pfizer, according to UBS, is exactly what we just said: there’s not much going on now that the COVID-19 frenzy has died down. Indeed, Pfizer cut its guidance just days ago. Worse, UBS analysts noted, there’s still a significant slug of uncertainty about COVID-19 in general, along with declining numbers of interested people looking to get the various shots.

That alone might be bad enough, but it comes hot on the heels of pricing data on Pfizer’s Paxlovid drug. With the government no longer buying supplies and the pandemic phase largely out of frame, Pfizer had to reconsider the sales price of Paxlovid, its COVID-19 treatment drug. There were reports that it might increase as much as five-fold. Thankfully, it did not go that high. It merely doubled and then some. Yes, Paxlovid will now run $1,390 for a five-day course, and that is before insurance kicks in. Considering that the U.S. government was charged $530 for the same dose, that’s likely going to cause more than a little outcry.

Is Pfizer Undervalued or Overvalued?

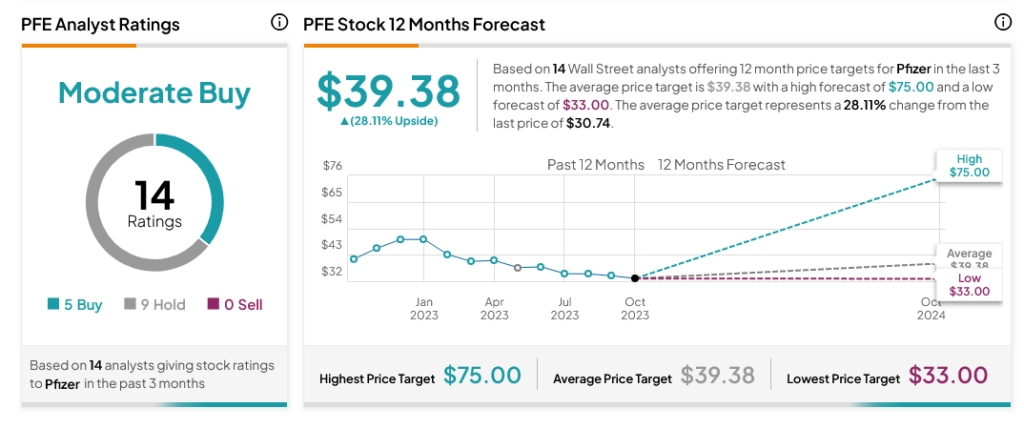

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PFE stock based on five Buys and nine Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average Pfizer price target of $39.38 per share implies 28.11% upside potential.