Pharmaceutical giant Pfizer (NYSE:PFE) is looking to discover alternative drugs to boost sales. The rise and fall of the COVID-19-related vaccines worked like a short-term fairy tale for the drug maker. Now, however, as the virus diminishes in magnitude and intensity, Pfizer is left with little demand for its COVID shots. The pharma company is betting on the launch of 19 new drugs or their expanded uses in the coming months to reignite its sales growth. PFE stock has lost 29.5% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In its second quarter Fiscal 2023 results, Pfizer reported a 54% fall in revenue compared to the prior year period, mainly from a slump in sales from Paxlovid and Comirnaty. Pfizer expects sales from Comirnaty to contribute roughly $13.5 billion (down 75%), while Paxlovid will bring in another $8 billion (down 58%) in annual revenues this year. Plus, the damage done to Pfizer’s North Carolina manufacturing plant from the recent tornado could also affect its 2023 sales.

The drug maker also faces the threat of declining sales of its other big-selling drugs as its patents are set to expire in the coming years. Pfizer forecasts losing as much as $17 billion in annual sales from these patent expirations.

These Initiatives Could Expand Pfizer’s Sales

To avert the crisis, Pfizer says it is building momentum in sales of other drugs such as Prevnar 20, Zavzpret, and Abrysvo. Similarly, the company is racing ahead with the investigation and studies of drugs for treating hemophilia A or B, multiple myeloma, and breast cancer treatments. The U.S. Food and Drug Administration (FDA) has approved four new drugs from the company so far this year.

Most importantly, Pfizer is putting in every effort to get the Federal Trade Commission’s approval for its proposed $43 billion acquisition of Seagen (NASDAQ:SGEN). Seagen is a biotechnology company that discovers, develops, and commercializes transformative medicines for treating cancer. If all goes well, the acquisition is expected to close by year-end 2023 or early 2024. The company forecasts that Seagen could contribute roughly $10 billion in annual sales by 2030.

What is the Price Target for PFE Stock?

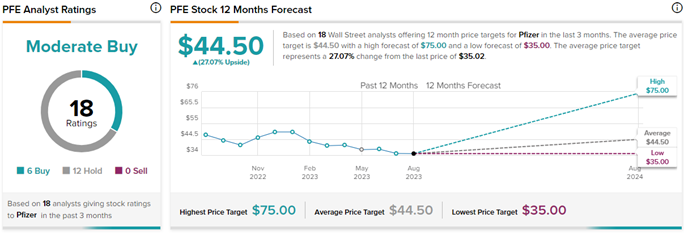

Following the company’s Q2 report, a number of analysts lowered the price target on PFE stock due to the uncertainty around an uptick in sales in the near future. On TipRanks, Pfizer stock has a Moderate Buy consensus rating based on six Buys and 12 Hold ratings. The average Pfizer price target of $44.50 implies 27.1% upside potential from current levels.