Over the next three years, Pfizer (NYSE:PFE) is planning to invest about €1.2 billion in its Puurs manufacturing facility to boost production capacity, cold storage options, and packaging processes. The expansion is expected to create about 250 additional jobs at the site.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Pfizer develops, manufactures, and sells healthcare products, including innovative medicines and vaccines.

Pfizer said that a portion of the investment is targeted to build an Isolator Facility Center (IFC) with a couple of production modules to increase filling capacity. Further, it seeks to construct a flexible freezer warehouse and bolster secondary packaging capacity with 16 additional cabins.

Interestingly, Pfizer had announced plans to make a similar investment in Ireland. The company plans to double its capacity for biological drug substance manufacturing by building a new facility by 2027.

In terms of the financials, Pfizer reported upbeat Q3 results last month, with adjusted earnings soaring 40% year-over-year to $1.78 per share, beating analysts’ estimates of $1.39. Q3 revenues declined 6% year-over-year to $22.6 billion but exceeded Street estimates by $1.5 billion.

Is PFE a Good Stock to Buy?

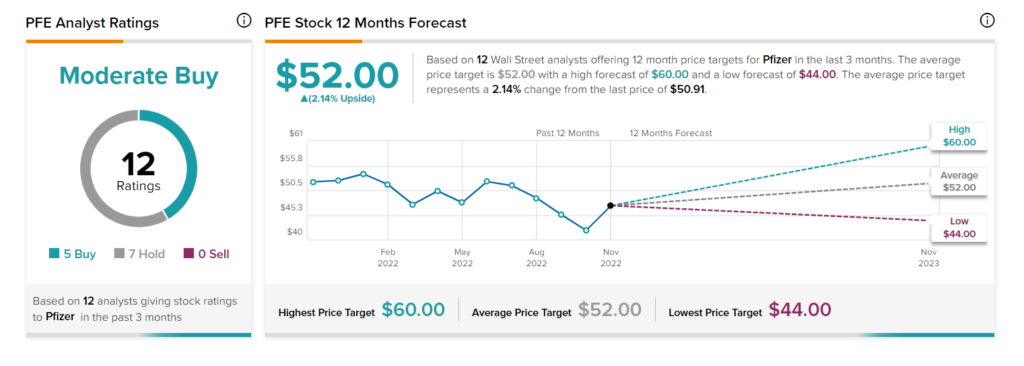

On TipRanks, PFE stock has a Moderate Buy consensus rating based on five Buys and seven Holds. The average Pfizer stock price target of $52 implies 2.14% upside potential. The stock is down nearly 7% so far this year.