Pfizer’s (NYSE:PFE) third-quarter EPS of -0.17 came in wider than the Street’s expectations by $0.09. Further, the widely anticipated decline in sales of its COVID-19 products Paxlovid and Comirnaty led to a nearly 41.6% year-over-year decline in revenue to $13.2 billion. Still, the figure landed lower than expectations by about $140 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The wider-than-anticipated net loss was primarily due to $5.6 billion in non-cash inventory write-offs and other charges. At the same time, revenue from the company’s non-COVID-19 products rose by 10%. Pfizer has now launched a cost realignment program and expects to realize at least $3.5 billion in net savings by the end of next year.

During the quarter, Pfizer witnessed marked sales contraction across its Global Pharmaceuticals, Primary Care, Oncology, and Business Innovation verticals. However, the healthcare giant is also experiencing green shoots of growth from new product launches and expects operational revenue growth from its non-COVID-19 portfolio to be between 6% and 8% for the full year.

The company now expects revenue for Fiscal year 2023 to hover between $58 billion and $61 billion. EPS for the year is anticipated to land between $1.45 and $1.65. Notably, this outlook implies a decline in the company’s top line to the tune of 41% to 38% as compared to 2022 owing to an anticipated 70% decline in Comirnaty sales and a 95% decline in Paxlovid sales for 2023.

What Is the Future of PFE Stock?

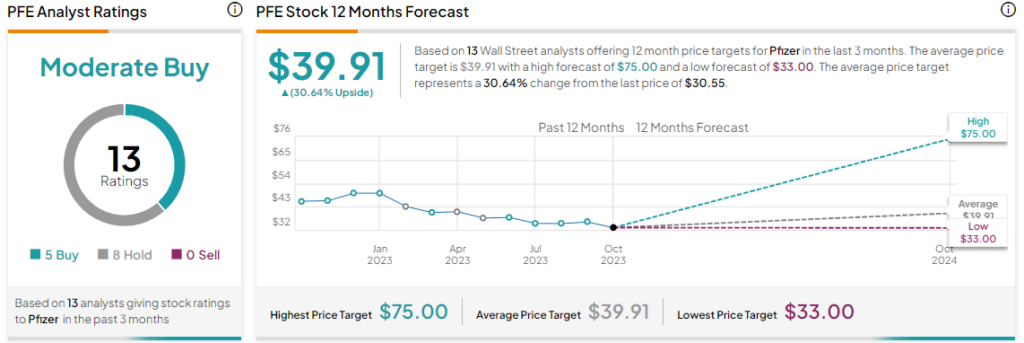

Overall, the Street has a Moderate Buy consensus rating on Pfizer. The average PFE price target of $39.91 implies a significant 30.6% potential upside. Shares of the company have tanked by nearly 35% over the past year.

Read full Disclosure