Shares of Pfizer (PFE) gained in pre-market trading on Tuesday after the company reported strong third-quarter results. The pharmaceutical and biotech company swung to a profit in the third quarter and reported adjusted earnings of $1.06 per share, above consensus estimates of $0.61 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

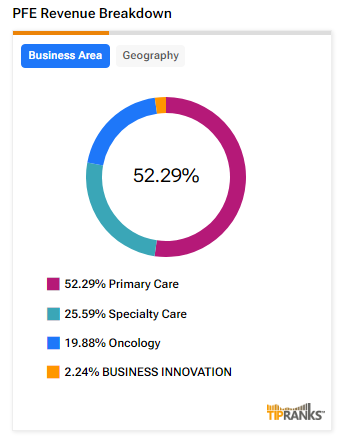

PFE’s Oncology Portfolio Drives Growth in Q3 Revenues

Furthermore, the company’s revenues increased by 31% year-over-year to $17.7 billion. This exceeded analysts’ expectations of $14.9 billion. Pfizer’s growth in revenues in the third quarter was driven by its treatment for COVID-19, Paxlovid, and the strong performance of its Oncology drugs portfolio.

In fact, this business segment posted revenues of $4.04 billion in the third quarter, up by 29.8% year-over-year, and comprised more than 19% of PFE’s total revenues.

PFE Raises FY24 Outlook

Looking ahead, management now expects FY24 revenues in the range of $61 billion to $64 billion, compared to its prior forecast between $59.5 billion and $62.5 billion. In addition, adjusted earnings are estimated to be in the range of $2.75 to $2.95 per share, compared to the previous outlook between $2.45 and $2.65 per share. For reference, analysts estimate earnings of $2.66 per share on revenues of $61.1 billion.

The company’s raised outlook now includes around $10.5 billion in anticipated revenues generated from its COVID-19 drugs, Comirnaty and Paxlovid. Furthermore, Pfizer now expects that its cost-saving initiatives will result in delivering at least $4 billion in savings by the end of this year. Moreover, the first phase of the cost-saving initiative is likely to deliver $1.5 billion in savings by 2027.

Is PFE a Good Stock to Buy?

Analysts remain cautiously optimistic about PFE stock, with a Moderate Buy consensus rating based on seven Buys and 14 Holds. Year-to-date, PFE has increased by more than 4%, and the average PFE price target of $32.47 implies an upside potential of 12.5% from current levels. These analyst ratings are likely to change following PFE’s results today.