Petco Health and Wellness Company posted better-than-expected results for the fiscal fourth quarter (ended Jan. 30), driven by digital sales growth of 90%. Shares of the pet health and wellness business operator rose 1.4% in Thursday’s extended trading session after closing 3.8% lower on the day.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Petco’s (WOOF) 4Q adjusted earnings increased 88.9% to $0.17 per share on a year-over-year basis and beat Street estimates of $0.11 per share. Net sales jumped 16% to $1.34 billion and surpassed analysts’ expectations of $1.31 billion.

The company’s comparable sales growth was 17% during the quarter. Additionally, adjusted EBITDA expanded 13% to $148.6 million. (See Petco stock analysis on TipRanks)

Petco CEO Ron Coughlin commented, “On the heels of a successful IPO in January, we closed the year with a strong fourth quarter, and that momentum has carried into 2021.”

For fiscal 2021, the company projects revenues and adjusted earnings to be in the range of $5.25-$5.35 billion and $0.63-$0.66 per share, respectively. Consensus estimates for revenues and earnings are pegged at $5.24 billion and $0.60 per share, respectively.

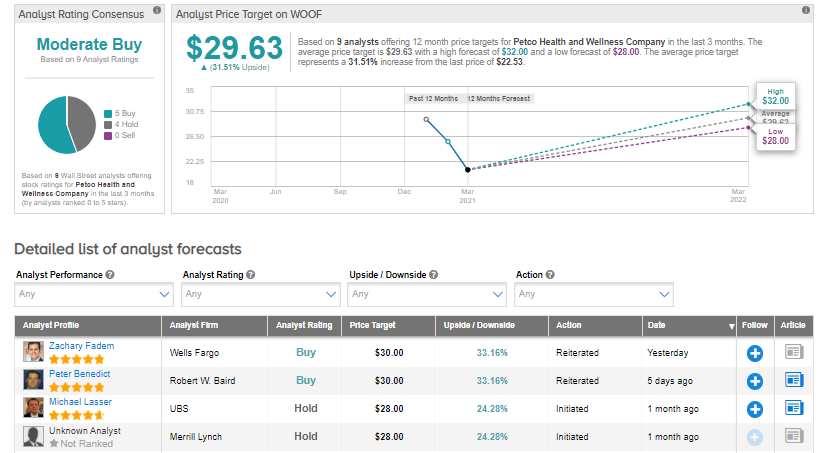

Following the 4Q results, Wells Fargo analyst Zachary Fadem maintained a Buy rating and a price target of $30 (33.2% upside potential) on the stock.

Fadem believes “today’s print should solidify investor confidence that the Petco growth story remains early days, upside levers are plentiful and ongoing tailwinds (via stimulus, a strong consumer, category growth) remain robust.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 5 analysts suggesting a Buy and 4 analysts recommending a Hold. The average analyst price target of $29.63 implies a 31.5% upside potential to current levels.

Related News:

Signet Jewelers’ Sales Outlook Tops Estimates After 4Q Beat; Shares Jump Pre-Market

Smartsheet Posts Better-Than-Feared Quarterly Loss, Sales Outperform

Jabil’s Sales Guidance Tops Estimates After 2Q Beat; Shares Jump Pre-Market