PerkinElmer Inc. (PKI) has agreed to acquire Nexcelom Bioscience for a total cash consideration of $260 million. The acquisition is expected to close in Q2.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

PerkinElmer serves the diagnostics, life sciences, and applied services industries through its vaccine, cell, and gene research products and solutions.

Nexcelom provides automated cell counting and imaging products along with assays, cell reagents, and consumables.

The acquisition enhances PerkinElmer’s preclinical product portfolio as well as its QA/QC expertise in cell and gene therapy, and the manufacture of biologics.

PerkinElmer President and CEO Prahlad Singh said, “We are looking forward to bringing Nexcelom’s expertise and technologies in drug development together with our passion and solutions for drug discovery.” (See PerkinElmer stock analysis on TipRanks)

Singh added, “This combination will expand our efforts to help academic, government and biopharmaceutical organizations streamline their complete workflows and support efforts to accelerate time to target and time to market for novel therapies.”

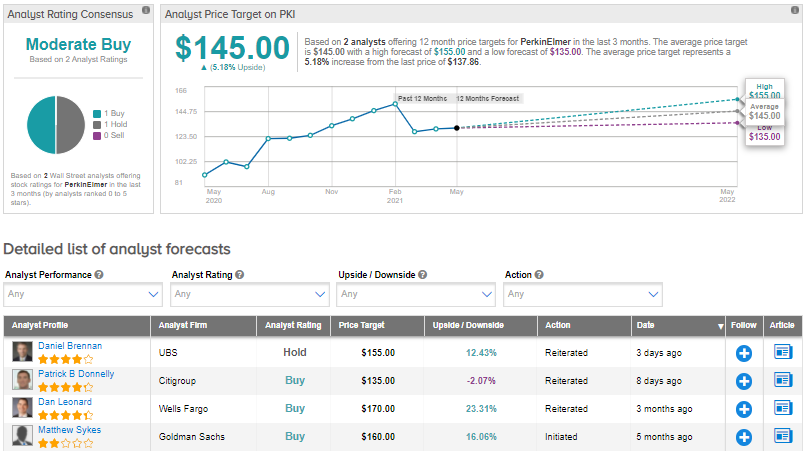

On May 5, Citigroup analyst Patrick B Donnelly reiterated a Buy rating on the stock but lowered the price target to $135 from $155.

During PerkinElmer’s recent Q1 conference call, Donnelly asked for more clarity on revenue visibility and cost synergies following the earlier Oxford Immunotec acquisition and its specific performance drivers.

In response, Singh noted the “strong” rebound from 2020 levels and said he expected testing levels to remain above those of 2019.

Singh further explained that the Oxford deal is going well, citing good traction on the T-cell piece the team has launched as well as early wins in automation deals.

Another analyst covering PerkinElmer, UBS’ Daniel Brennan, has a Hold rating on the stock with a $155 price target.

The two ratings add up to a Moderate Buy consensus rating alongside a $145 price target (5.2% upside potential). Shares have gained about 49.9% over the past year.

Related News:

Amazon Expanding In Louisiana With Robotics Fulfillment Center

Luminar Partners With Toyota’s Pony.ai To Enhance Safe Autonomous Driving

Dish Network Taps Debt Market To Raise $1.25B For Broadcast Unit