Beverage giant PepsiCo (PEP) will release its Q3 2025 earnings on October 9. The company, known for its global snack and beverage brands, has lost about 5% year-to-date and 14% over the past year due to softer beverage demand in North America and higher input costs that have weighed on margins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

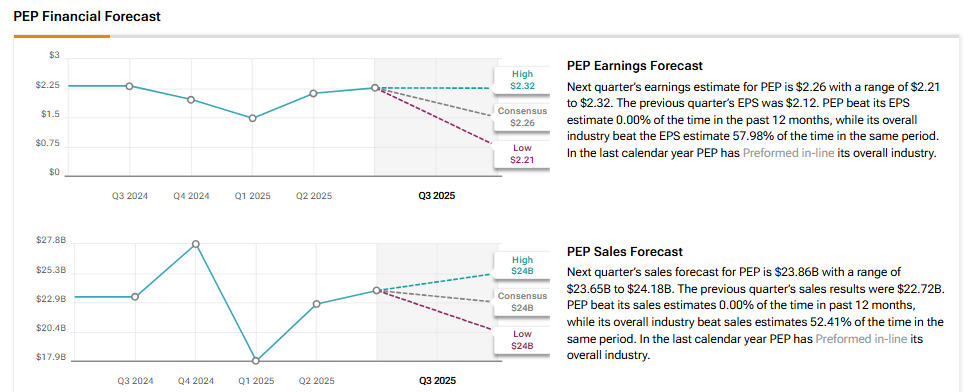

Wall Street analysts expect PepsiCo to report Q3 earnings per share (EPS) of $2.26, slightly below the $2.31 posted in the same quarter last year. Meanwhile, revenue is projected to be $23.86 billion, according to PepsiCo’s analyst forecasts page on TipRanks. This reflects a modest increase of 2.3% year-over-year. Notably, PEP has beaten earnings estimates in eight of the past nine quarters.

As part of its product strategy, PepsiCo has begun reducing the use of artificial dyes in snacks like Lay’s and Doritos, replacing them with natural ingredients. The move aligns with the company’s efforts to simplify ingredient lists and respond to growing consumer demand for healthier products.

Analysts’ Views Ahead of PepsiCo’s Q3 Earnings

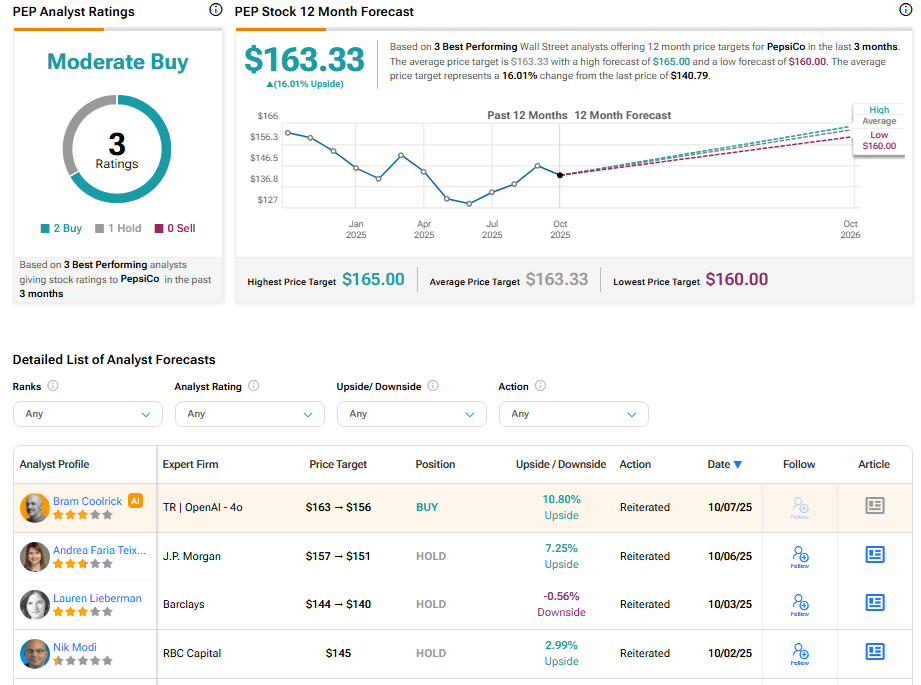

Ahead of the report, JPMorgan analyst Andrea Faria Teixeira lowered the firm’s price target on PepsiCo to $151 from $157, while maintaining a Neutral rating. The analyst said she does not expect much fundamental improvement this quarter, citing continued pressure on volumes and limited near-term catalysts.

Similarly, Citi analyst Filippo Falorni trimmed the price target to $165 from $168, but kept a Buy rating. Falorni expects soft results, pointing to ongoing weakness in North America and a smaller contribution from international markets.

Options Traders Anticipate a Minor Move

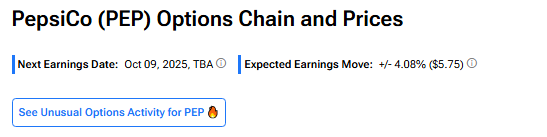

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 4.08% move in either direction.

Is PepsiCo a Good Stock to Buy?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PEP stock based on four Buys and nine Holds assigned in the past three months. At $156.33, the average PEP price target implies a 10.1% upside potential.