Good news for PepsiCo (NASDAQ:PEP) fans—or just Pepsi fans—as the beverage stock notched up fractionally in Monday afternoon’s trading. It managed to add some weight after a new analyst take suggested that there’s more growth potential under the hood than we’ve already seen, and investors may be in a good position to take advantage of that good news.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

PEP Stock to Benefit from Past Investments

PepsiCo’s upward effervescence started with word from Jefferies, as analyst Kaumil Gajrawala declared it the “most likely” name in beverages to see earnings increase by either high-single digit levels or more. Gajrawala points out that the series of investments PepsiCo has made over the years—in capital expenditures, marketing, and mergers—has paid off and provided a series of new growth vectors. Thus, Gajrawala has a Buy rating on PepsiCo and a price target of $203, which represents a roughly 20% upside against the current price.

Indeed, PepsiCo has already been making aggressive moves to free up cash and improve its operations. Not long ago, it sold the Tropicana juice line to a private equity firm and now reports note it may have another sale in mind. This time, it’s Quaker Oats, which it picked up just to get its hands on the Gatorade brand. Now, with PepsiCo joining a slew of companies who are streamlining operations and focusing on their big names, it may just end up selling Quaker Oats to someone who might better incorporate its lineup into their own operations.

Is PepsiCo a Buy or Sell?

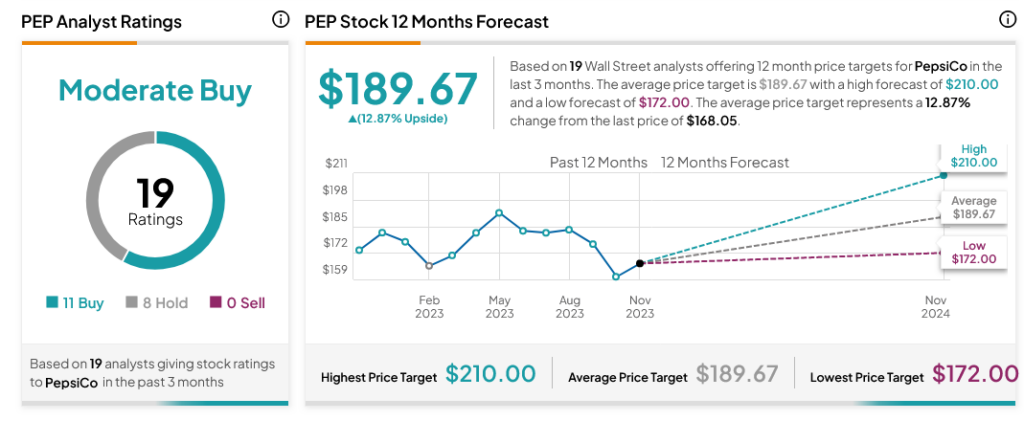

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PEP stock based on 11 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 2% drop in its share price over the past year, the average PEP price target of $189.67 per share implies 12.87% upside potential.