Shares of casino and sports betting services provider PENN Entertainment (NASDAQ:PENN) are in focus today after a Wall Street Journal report indicated that a major shareholder in the company is seeking Board seats.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reportedly, HG Vora Capital management is in discussions with the company to place directors on its Board. The hedge fund owns an 18.5% interest in PENN. The WSJ noted that if the talks fail to bear fruits, HG Vora could take the route of a proxy battle.

The company’s window for director nominations is between January 8 and February 7. Since its March 2021 high of about $130, PENN’s share price has plummeted to the current $25 level. Over the past two years, while its top line has ticked up, the company’s bottom line has seen a contraction.

Further, after spending nearly $550 million on Barstool Sports in 2020, the company rebranded its Barstool sportsbook to ESPN Bet. Citing PENN’s poor M&A track record and share price undervaluation, HG Vora is now looking to turn the company’s fortunes around.

What is the Future Price of PENN Stock?

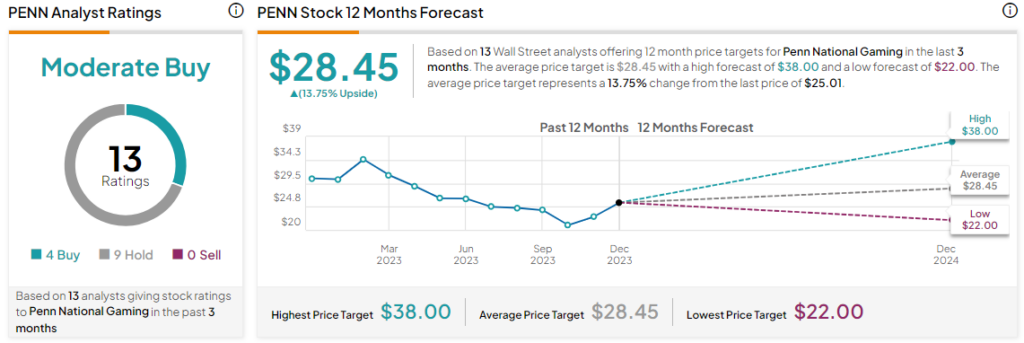

Overall, the Street has a Moderate Buy consensus rating on PENN Entertainment, and the average PENN price target of $28.45 implies a modest 13.75% potential upside in the stock.

Read full Disclosure