Penguin Solutions (PENG) stock was down on Wednesday following the release of its Fiscal Q4 2025 earnings report. In that report, the enterprise solutions company posted adjusted earnings per share of 43 cents alongside net sales of $338 million. While this beat Wall Street’s adjusted EPS estimate of 38 cents, it came in below analysts’ revenue estimate of $342.11 million. That’s despite a 9% year-over-year increase in revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Penguin Solutions also provided its guidance for Fiscal 2026 in its latest earnings report. The company expects adjusted EPS to range from $1.75 to $2.25 alongside a year-over-year revenue change of -4% to 16%. For comparison, Wall Street expects adjusted EPS of $2.10 alongside revenue of $1.48 billion.

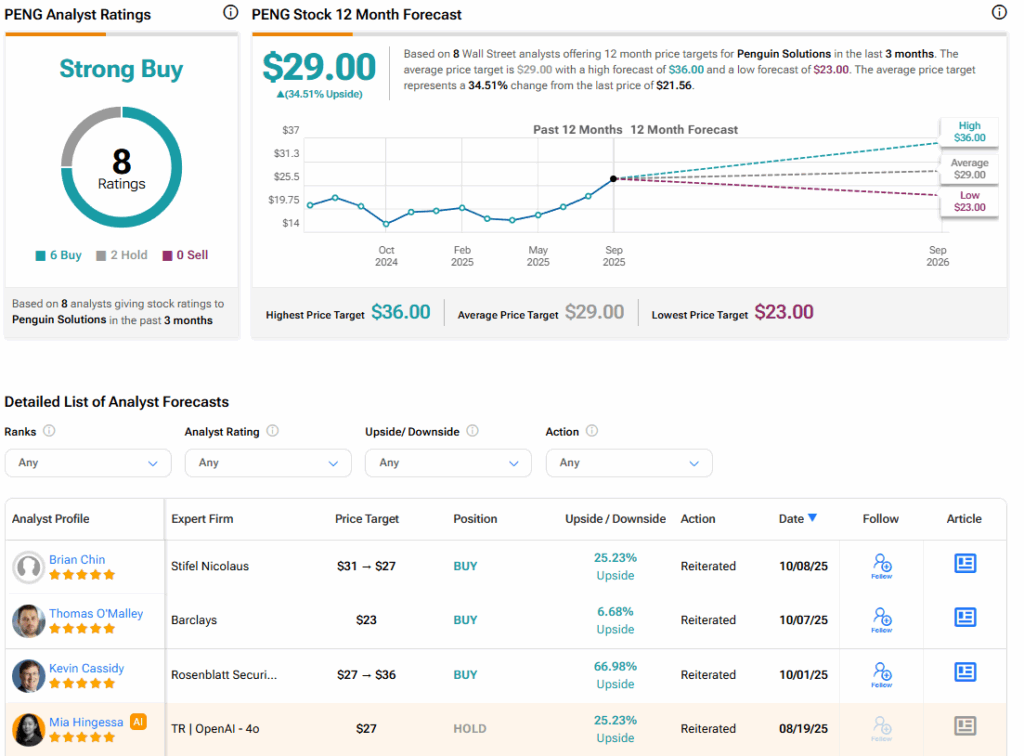

Penguin Solutions’ most recent earnings report prompted updated analyst coverage. Five-star Stifel Nicolaus analyst Brian Chin reiterated a Buy rating but cut his price target to $27 from $31, suggesting a 25.23% upside. Five-star Barclays analyst Thomas O’Malley reiterated a Buy rating and $23 price target for the shares, implying a 6.68% upside.

Penguin Solutions Stock Movement Today

Penguin Solutions stock was down 19.63% on Wednesday but remained up 13.08% year-to-date. The shares were also up 30.56% over the past 12 months. Trading volume is high today, with some 2.42 million shares exchanged, compared to a three-month daily average of about 949,000 units.

Is Penguin Solutions Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Penguin Solutions is Strong Buy, based on six Buy and two Hold ratings over the past three months. With that comes an average PENG stock price target of $29, representing a potential 34.51% upside for the shares. These ratings and price targets will likely change as more analysts update their coverage after the company’s earnings report.