American digital payments platform PayPal Holdings, Inc. (PYPL) reported in-line first-quarter results but cut its full-year fiscal 2022 forecast. The company added 2.4 million net new active accounts (NNA) in the quarter, growing 1% sequentially and 9% year-over-year to 429 million total accounts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

At the time of writing, shares are up 4.1% during pre-market trading. Year-to-date, the stock has lost more than 50% of its value owing to the tech sell-off frenzy.

PayPal’s Q1 Results in Detail

PayPal’s Q1 revenue of $6.5 billion jumped 7% year-over-year and fell in line with analysts’ estimates.

Transaction revenues, its major revenue contributor, leaped 7% to nearly $6 billion compared to the year-ago period, boosted by an 18% year-over-year jump in the number of payment transactions.

Notably, PayPal’s total payment volume (TPV) increased 13% year-over-year to $323 billion, of which Venmo processed $57.8 billion in TPV, growing 12% year-over-year.

Similarly, quarterly adjusted earnings of $0.88 per share also matched analyst estimates but declined 28% compared to the year-ago period. The Q1FY22 figure includes a one-time negative impact of $0.03 per share resulting from the suspension of operations in Russia.

Lowered FY22 Outlook

Based on uncertain geopolitical conditions and difficult e-commerce penetration, with the majority of PayPal consumers spending on discretionary items, PayPal lowered its guidance for the full year fiscal 2022.

In Q2, PayPal expects revenue to grow by 9% compared to the same period last year. Moreover, Q2 adjusted earnings are projected at $0.86 per share, while the consensus is pegged much higher at $1.12 per share.

For FY22, based on a TPV guide of more than $1.4 trillion, the company forecasts full-year revenue growth of between 11% and 13% compared to the year-ago period. Excluding eBay, revenue is expected to grow by 15%-17%.

Additionally, FY22 adjusted earnings are projected in the range of $3.81 per share to $3.93 per share, compared to the prior guidance of $4.60 per share to $4.75 per share and much lower than the consensus estimates of $4.63 per share. Remarkably, PayPal expects to add approximately 10 million NNAs in FY22.

Analysts’ Take

Following PayPal’s quarterly performance, Mizuho Securities analyst Dan Dolev assigned a Buy rating to the stock with a price target of $175, which implies a whopping 111.8% upside potential to current levels.

Dolev’s price target calculation is based on 24x their 2024 estimated EPS, which is roughly in line with the target multiples of both Visa (V) and MasterCard (MA) owing to their broad-based exposure to e-commerce.

Commenting on the results, Dolev said, “The 1Q sales beat is a positive, as is-hopefully-the guide reset. However, with slowing NNAs, disappointing Venmo stats, and questions regarding the future of the checkout button, we believe mgmt. has some explaining to do.”

Overall, the analysts on the Street have a cautiously optimistic view of PYPL stock with a Moderate Buy consensus rating based on 29 Buys, ten Holds, and one Sell. The average PayPal price forecast of $163.92 implies 98.4% upside potential to current levels.

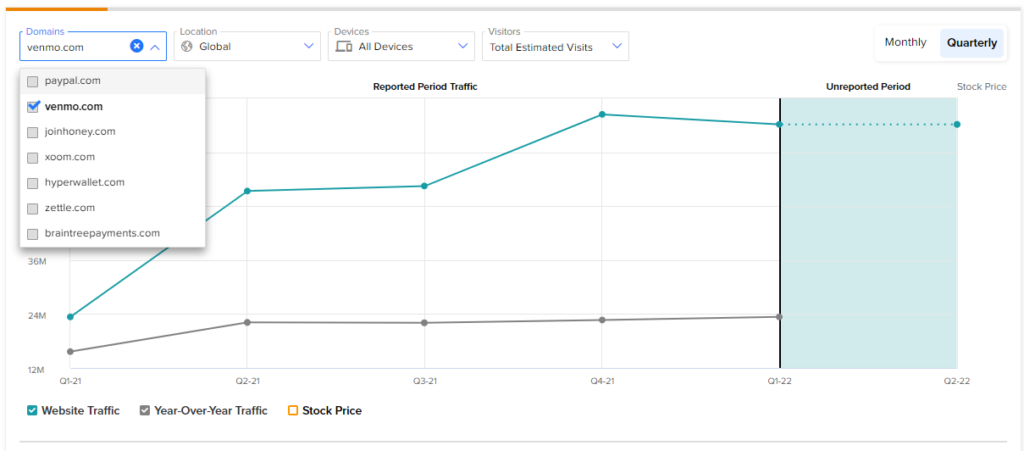

PayPal Website Traffic

According to the TipRanks’ Website Traffic Tool, in Q1, PayPal’s website traffic visits for Venmo declined 3.26% sequentially across all of its devices globally. Interestingly, this trend also correlates with the 6% sequential decline in transaction revenue reported by the company in Q1FY22.

Similarly, as per the tool, the year-over-year growth in estimated global visits for Venmo also correlates with the year-over-year uptick in advertising revenue for the reported quarter.

Ending Notes

PayPal is one of the most battered payments stocks. Hopefully, the company will be able to beat its revised lowered guidance and emerge a winner from the current lows. It’s a wait-and-watch game for the company right now.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

Why Did Boeing Drop to an All-Year Low?

Why Lower Revenue Bothers Meta Despite Q1 Earnings Beat & FB User Growth?

Microsoft Posts Upbeat Q3 Results on Cloud Strength, Provides Strong Guidance