When PayPal (NASDAQ:PYPL) got started, it was unquestionably the king of quick and painless cash transfers online. In many ways, it still is. Or rather, it’s one king among several these days. That, along with a range of other factors, is prompting concern from analysts, which sent PayPal stock down slightly in Monday afternoon’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The downgrade came from MoffettNathanson, via analyst Lisa Ellis. Ellis noted that PayPal’s competitive landscape is not as flat as it once was. In fact, it’s nowhere near. Scads of firms are getting involved in the mobile payments space, and with names as big as Apple (NASDAQ:AAPL) getting involved, that’s going to leave PayPal struggling to keep its edge. What’s more, PayPal’s growth rate is slowing substantially, down to virtually nil in 2022, and so far, up just 1% against that flat growth from last year.

Yet, PayPal isn’t without resources. It’s working to improve its use of Venmo and also bear up its Braintree pricing efforts, though the exact impact of those two moves is somewhat limited at best and, worse, not exactly clear. PayPal is also stepping up its stablecoin ambitions, bringing out a PayPal-branded digital currency that’s immediately connected to major world currencies. But with Tether’s co-founder, William Quigley, suggesting that PayPal’s coin ambitions won’t be especially innovative, that doesn’t bode well either. Further, Quigley himself was an early investor in PayPal, suggesting that he understands the potential and constraints of this market fairly well.

What is the Future of PYPL?

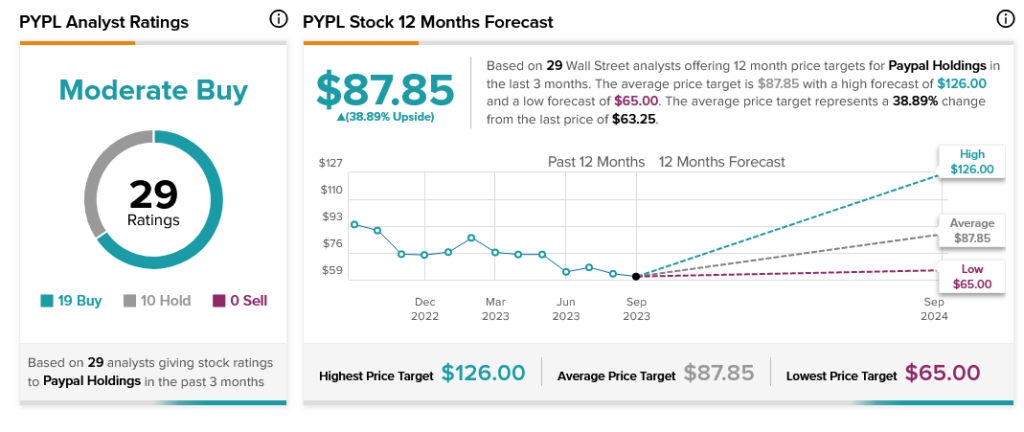

Meanwhile, analysts are mostly on board with PayPal. Thanks to 19 Buy ratings and 10 Holds, PayPal stock is considered a Moderate Buy. Further, PayPal stock offers investors 38.89% upside potential thanks to its average price target of $87.85.