Vanda Pharmaceuticals (NASDAQ:VNDA) investors likely won’t be getting a good night’s sleep for a while, despite making a sleep disorder treatment drug known as Hetlioz. The company recently attempted to wage a patent infringement suit against Teva Pharmaceuticals (NYSE:TEVA) that would have limited Teva’s ability to compete. It didn’t go well. The market’s subsequent outrage hit Vanda for around a quarter of its market cap in Tuesday trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Hetlioz suit hit Vanda like a bus. A federal judge offered a two-pointed ruling that hit Vanda on each point. Vanda alleged that generic versions of Hetlioz released by Teva—and also released by Canadian firm Apotex Inc—infringed on Vanda’s patents. The judge disagreed. Further, the judge also ruled that four of Vanda’s intended patent claims were invalid to begin with.

That may not sound like bad news, but Hetlioz is a major part of Vanda’s entire portfolio. Hetlioz sales, for the first three quarters of this year, accounted for nearly two-thirds of Vanda’s product revenue. That comes to $189.9 million so far. With Hetlioz now basically available as a generic version from Teva and Apotex, Vanda’s share of that market is likely about to crash.

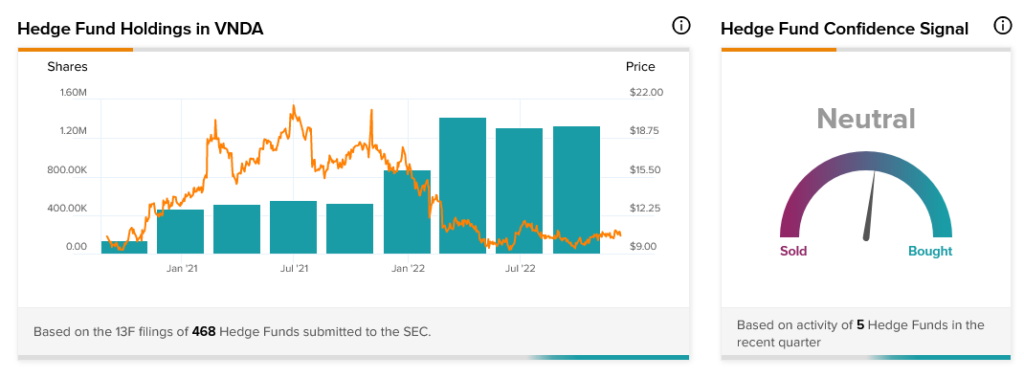

Despite this clear setback, there’s one front still in favor of Vanda: hedge funds. In the last quarter, hedge funds raised their holdings of Vanda by 20,600 shares. That’s a modest hike, but a hike nonetheless. Even though it merely leaves hedge funds on the slightly positive side of neutral. That suggests all may not be lost yet for Vanda, even if it’s not looking that good.