In a recent twist to Paramount Global’s (NASDAQ:PARA) attempt to sell its book publishing house, Simon & Schuster, another potential buyer has entered the bidding race. Based on several updates relating to the sale in the past week, PARA stock has been attracting investors’ attention. The latest development is expected to further spike investor interest, as indicated by the gradual uptrend observed in the stock’s trading during the early hours of Thursday.

According to a report from the Wall Street Journal, investor Richard Hurowitz, supported by Abu Dhabi-based sovereign wealth manager Mubadala Investment Co., has expressed interest in acquiring Simon & Schuster.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Richard Hurowitz is presently serving as the CEO of Octavian & Co., an investment company headquartered in New York. Additionally, he holds the position of publisher for the quarterly magazine, The Octavian Report. Hurowitz is also known as the author of the book “In the Garden of the Righteous: The Heroes Who Risked Their Lives to Save Jews During the Holocaust.”

In the recent race to acquire Simon & Schuster, private equity firm KKR & Co. (NYSE:KKR) and News Corp.’s (NASDAQ:NWSA) HarperCollins emerged as the leading contenders last week. Both entities were actively involved in the bidding process. It is anticipated that a second round of bids for the sale will take place in mid-July, indicating a significant step forward in the transaction.

It is notable that these recent bids for Simon & Schuster are part of Paramount Global’s second endeavor to sell the publishing house. Last year, PARA’s agreement to sell Simon & Schuster to Penguin Random House was thwarted by the U.S. Justice Department, citing concerns related to antitrust regulations.

Is PARA a Buy or Sell?

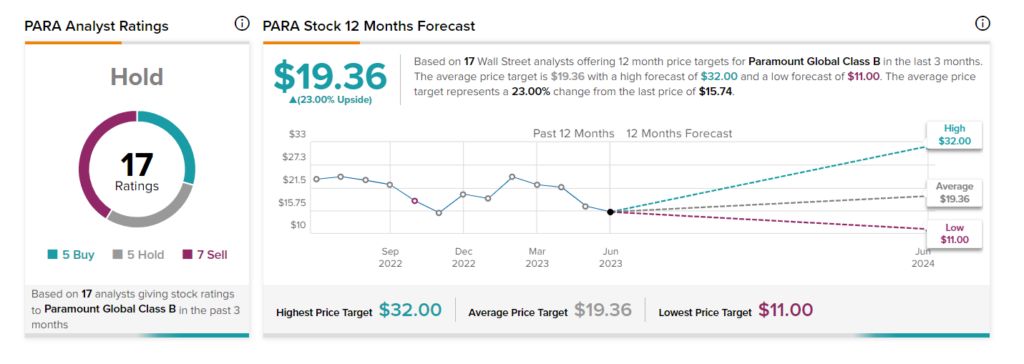

On TipRanks, PARA stock currently has a Hold consensus rating based on five Buys, five Holds, and seven Sell ratings. Meanwhile, the average Paramount price target of $19.36 implies 23% upside potential from current levels. The stock has lost 6.4% year-to-date.