Shares of media giant Paramount Global (NASDAQ:PARA) rallied today after its credit rating was downgraded to junk status by S&P. This downgrade reflects concerns over declining performance in traditional media and the firm’s uncertain future in the fiercely competitive streaming market. The reason why investors see this as a positive is because it can actually make it easier for PARA to be acquired by eliminating the need to repay existing debt immediately upon a change of control, according to Wells Fargo.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Currently, Paramount has a market cap of around $8 billion, contrasted by a substantial net debt of around $11.4 billion. Apollo’s (NYSE:APO) existing $11 billion offer for Paramount’s studio operations represents a premium over its market capitalization but doesn’t account for the hefty debt load. As a result, by cancelling the need to immediately repay debt, it lowers the financial risks associated with a takeover.

Furthermore, the voiding of debt change-of-control clauses might encourage bids not just for the studio but also for valuable assets like BET, Nickelodeon, and CBS, thereby unlocking more value for Paramount.

Is Para a Buy or Sell?

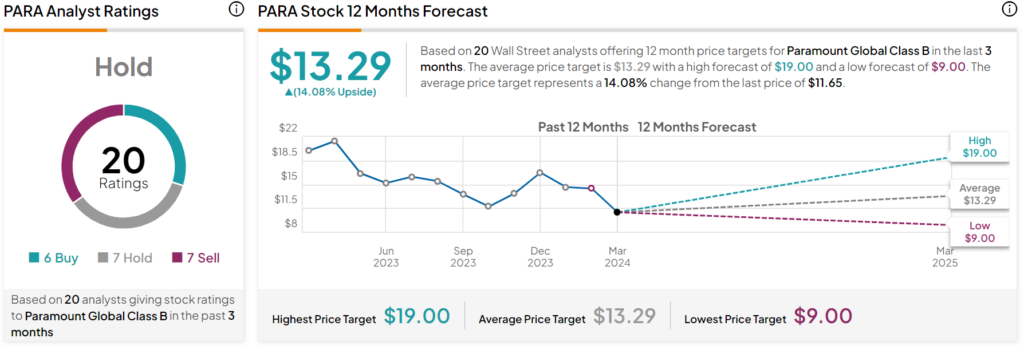

Turning to Wall Street, analysts have a Hold consensus rating on PARA stock based on six Buys, seven Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 46% decline in its share price over the past year, the average PARA price target of $13.29 per share implies 14.1% upside potential.